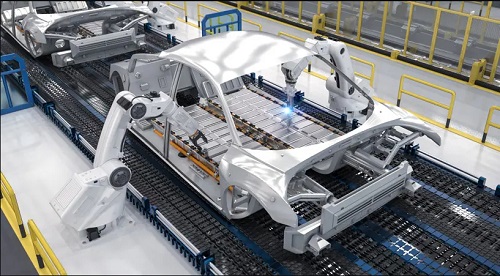

Electric vehicles are less complex than gasoline-powered ones. They lack gas tanks, pistons, spark plugs, and tailpipes. Assembly specialist Chris Rehrig explains that the concept involves fewer parts, amidst the plant’s noise.

Offline, they are equipped with large batteries. At Volkswagen, battery packs weighing over 1,000 pounds will be assembled across the street and transport in by autonomous vehicles. Each battery pack, encased in a plate with cooling fluid, will be attached to a car’s underbody using automated tools.

When a gasoline-powered car approaches, the same machine will instead install a heat shield. Ensuring a smooth operation will require coordination, as noted by Noah Walker, Rehrig’s supervisor.

The fact that Volkswagen and many others are now attempting this transition indicates a critical moment for the planet. The company and the industry are shifting away from what made Volkswagen the world’s largest manufacturing company by revenue: the carbon dioxide-emitting internal combustion engine.

As more individuals and governments advocate for urgent action on climate change, cars and trucks are experiencing their most significant transformation since their inception over a century ago. Both startups and established companies are vying for a position in what industry leaders now view as the most promising path forward: vehicles with no tailpipe emissions.

By almost every metric, their popularity is rapidly increasing. Overnight, the era of the electric car has arrived.

However, the transition away from gasoline-powered vehicles remains too slow to address the climate challenge within the necessary timeframe. Greenhouse gas emissions are on the rise, resulting in extreme droughts and wildfires from the Arctic to Australia, and breaking global temperature records.

Melting ice sheets are causing sea levels to rise, leading to increased flooding and more severe storms. To avert danger for millions of people, the Intergovernmental Panel on Climate Change states that the world needs to eliminate carbon dioxide emissions by 2050, preferably even sooner.

With nearly a quarter of global emissions stemming from all types of transportation, can we quickly reduce our dependence on gasoline-powered cars to avoid the most severe consequences? And can we do so without causing new environmental disasters? Several emerging companies and many traditional players are now staking their future—and ours—on the belief that millions of consumers are finally ready to make the switch.

It’s difficult to argue that we are witnessing anything less than a revolution. In the 1990s, General Motors introduced an electric car, produced fewer than 1,200 units, and recalled them. Today, the pace of change is rapid.

The number of all-electric and plug-in hybrid electric vehicles (EVs) increased by nearly half last year, despite an overall 16 percent decrease in car sales. The variety of models available to drivers worldwide expanded by 40 percent, totaling about 370.

In North America, the variety is projected to nearly triple by 2024, reaching 138. Electric Mini Coopers, Porsches, and Harley-Davidsons are already on the market.

Governments from California to China, Japan, and the United Kingdom have recently announced plans to prohibit the sale of new passenger vehicles powered solely by gas or diesel by 2035 or sooner. Automotive giants such as Volvo and Jaguar now say they will phase out piston engines by then, while Ford states that its passenger vehicles in Europe will be all EVs or hybrids in five years and all electric by 2030.

GM has committed to achieving carbon neutrality by 2040. President Joe Biden has vowed to transition the federal fleet of over 600,000 vehicles to EVs, and his administration plans to tighten fuel-efficiency standards.

Wall Street and investors are making substantial bets. At one point last year, Tesla, which was responsible for almost 80 percent of all US EV sales in 2020, was valued higher than oil giants ExxonMobil, Chevron, Shell, and BP combined. New electric car and electric truck companies continue to emerge: Bollinger, Faraday Future, Nio, Byton.

Others are gaining traction as well. A two-door electric micro-car with a top speed of 62 miles per hour and a starting price below $6,000 has been outselling Tesla in China, which is home to over 40 percent of the world’s plug-in vehicles.

The days of light-duty combustion engines appear to be truly numbered. “The dam is breaking; the tipping point is here,” says Sam Ricketts, a member of the team that authored Washington governor Jay Inslee’s climate action plan during his presidential run. Many of Inslee’s later ideas found their way into Biden’s climate plans.

“Electrifying transportation is our future. I think that train has left the station,” says Kristin Dziczek, an economist with the Center for Automotive Research, a Michigan-based organization partially backed by car manufacturers.

Even before the successful mass production of the Prius hybrid by Toyota over twenty years ago, some environmentally conscious countries had started to tighten emissions standards. For example, in Norway, where half of the new vehicles on the road in 2020 were electric, incentives such as tax savings for electric cars were introduced.

In China, cities dealing with air pollution issues streamlined the registration process for electric vehicles, making it faster and more cost-effective compared to vehicles with internal combustion engines. The US government also provided consumers with incentives of up to $7,500 for the purchase of electric vehicles and hybrids, while also investing in battery research and development.

In 2009, Tesla received a $465 million loan from the Department of Energy to kick-start sedan production. Over the next decade, battery prices dropped by 89 percent, and Tesla managed to sell 1.5 million plug-in vehicles.

However, there is still a long way to go. Globally, approximately 12 million plug-in cars and trucks have been sold, with nearly 90 percent of them in just three regions: China, Europe, and the United States. Despite this progress, there are still around 1.5 billion traditional gasoline-powered vehicles on the roads, and the total number of passenger vehicles, of all types, is projected to increase by another billion over the next 30 years due to rising incomes in underdeveloped countries.

The rapid adoption of electric vehicles by drivers worldwide depends on various factors. The industry is addressing some of the major obstacles for consumers, such as range, recharging times, charging infrastructure, and cost. For instance, a laboratory prototype of a solid-state battery could potentially enable electric vehicles to be recharged in just 10 minutes. Additionally, companies like Tesla and Lucid Motors are already developing all-electric vehicles that could exceed 400 miles per charge.

Lucid claims its car will surpass 500 miles, while Aptera suggests that some drivers of its three-wheeled, aerodynamic, solar-powered vehicle may never need to visit a charging station. Although most new electric vehicles are currently luxury cars that are out of reach for many consumers, investment bank UBS and research firm BloombergNEF predict that electric cars could achieve cost parity with conventional vehicles in approximately five years.

Nevertheless, analysts emphasize that more action is needed to accelerate this transition. It is not expected that the variety of options for consumers will match the range of choices available for traditional gasoline-powered vehicles in the near future. Government incentives, such as the reinstatement of the $7,500 tax credit, which is no longer available for certain automakers, may be crucial in attracting buyers.

According to Dziczek, “There isn’t a market in the world that can do this without some kind of public investment.” The Biden administration has proposed a $15 billion investment to help install 500,000 charging stations, but this has faced resistance from many in Congress.

The price and sustainability of electric vehicles also hinge on the availability of raw materials. EV batteries rely on materials such as lithium, nickel, cobalt, manganese, and graphite, most of which are mined in a few specific locations, with much of the refining taking place in China. With demand on the rise, nations that manufacture electric vehicles are working to secure supplies, including plans for a lithium mine in Nevada.

However, according to Jonathon Mulcahy of the research firm Rystad Energy, which projects potential lithium shortages later this decade, “there’s no point in having a lithium mine in America, shipping the lithium out to Asia for processing, then shipping it back to America for use in your batteries.”

At the same time, the extraction of these metals has led to environmental and human rights concerns. Entities like the European Union are grappling with ways to ensure stability,, and safe supply chains, while ethical automakers, including Volkswagen, are implementing auditing and certification systems to ensure that battery suppliers adhere to environmental and labor regulations.

Consumers may be hesitant to trust these commitments, as automakers have previously let them down. For example, when issues arise on Volkswagen’s Chattanooga assembly line, production is halted by workers pulling cords, and a distinctive song plays across the factory floor to identify the cause of the delay. During a tour, Scott Joplin’s “The Entertainer” was heard, signaling a stoppage in operations. However, on that particular day, significant progress was being made, such as the installation of special robots needed for EV production, the securing of new parts suppliers by buyers, and preparations for the hiring of hundreds more workers by executives.

The groundwork for this moment was laid in 1979 when Tennessee governor Lamar Alexander traveled to Japan with maps and a satellite photograph to persuade the chairman of Nissan that his state offered ideal manufacturing land connected by rail and highway to major population centers on both coasts. This led to other carmakers following suit, and today, this conservative state plays a role in the shift towards eco-friendly vehicles.

From 2013, the Nissan factory in Smyrna, located outside Nashville, has been producing the electric Leaf, the first commercially successful modern EV. Priced at under $25,000 after tax credits, it remains one of the most affordable options in North America.

Approximately 40 miles away, GM is investing two billion dollars to revamp its Spring Hill plant in order to manufacture an electric Cadillac, which will be the first of several EVs to be produced there. By 2023, the entire operation will be powered by solar energy .

The company is also dedicating $2.3 billion to establish a battery plant that will provide employment for 1,300 individuals. Additionally, the Tennessee Valley Authority, responsible for operating hydroelectric dams and other power plants, intends to finance fast-charging stations along Tennessee’s highways, with stations available every 50 miles.

Then there’s Chattanooga. In 1969, a year before the inception of the Environmental Protection Agency, the US government labeled the city’s particulate-matter pollution as the most severe in the country. Its ozone pollution was second only to that of Los Angeles.

After years of revitalization, the city achieved one of the most noteworthy environmental successes in history. In 2008, shortly after the city met ozone standards, Volkswagen initiated the construction of its new plant.

The Volkswagen Group, which includes Audi, Porsche, and nine other carmakers, has embraced EVs. This is partly due to the emissions scandal that came to light in 2014, resulting in substantial fines, the recall of millions of cars, and the indictment of its former CEO on conspiracy charges.

As part of a settlement with the EPA for installing devices on approximately 590,000 diesel vehicles sold in the US that misrepresented their pollution levels, the company was required to make substantial investments in EV charging infrastructure. However, this alone does not fully explain Volkswagen’s profound shift towards EVs.

The company is allocating over $40 billion globally to develop 70 new electric models and manufacture 26 million of them by 2030. In collaboration with partners, VW anticipates installing 3,500 fast chargers in the US by the end of the year and 18,000 in Europe by 2025.

Volkswagen has invested $300 million in a battery start-up aimed at reducing charging times by half. The company is also constructing and expanding battery plants across Europe with the goal of halving battery prices.

Nic Lutsey, director of the electric-vehicle program for the International Council on Clean Transportation, which provides data and analysis to aid governments in promoting environmentally friendly transportation, acknowledges Volkswagen’s substantial investments in EVs, stating, “It is absolutely clear that VW, among the large automakers, is by far making the largest investments in EVs.” It was Lutsey’s organization that first uncovered Volkswagen’s emission cheating.

Scott Keogh, CEO of Volkswagen Group of America, grew up in the 1970s on Long Island, riding in the back of his family’s VW Beetle. He pursued a degree in comparative literature and engaged in development projects in Bolivia before entering the automotive industry, initially at Mercedes-Benz and later at Audi. In 2018, following the EPA settlement, he assumed leadership of VW’s North American business.

Keogh acknowledges the emissions scandal as a corporate disaster, describing it as a significant setback for the company. However, he emphasizes the company’s decision to emerge from the crisis stronger, more resilient, and purpose-driven.

Volkswagen announced its commitment to EVs so early that when the plan was presented to US car dealers, Keogh notes that it was met with skepticism. Not long ago, dealers assumed EVs would remain a niche market.

Keogh asserts that this perception has since evolved. He regularly receives research indicating that, under optimistic scenarios, electric vehicles could account for 50 percent of car purchases within the next decade. Suddenly, VW’s investments appear astute and imperative.

However, Keogh is well aware of the challenges ahead. Currently, all-electric vehicles constitute less than 5 percent of new-car sales in Europe and 2 percent in the US (The figure rises to 8 percent in China.) Keogh anticipates that, within 10 years, this percentage could reach 30 to 40 percent. Counting on such rapid growth is certainly a source of concern.

Nevertheless, Keogh does not perceive Tesla or other EV manufacturers as the primary competitors. His target audience consists of individuals considering the purchase of small gas-powered SUVs, such as Toyota’s RAV4 or Subaru’s Forester. He emphasizes the company’s intense focus on the 98 percent of the market not currently driving an electric vehicle.

At the start, there was a similar competition for consumers’ attention. In 1896, during a major car exhibition in London, potential buyers were faced with a choice between electric and gas-powered vehicles, as horses and buggies still vied with automobiles. Some Aspects of this choice remain unchanged.

The British Medical Journal noted that electricity had the advantage of being odorless and producing less noise and vibration, but it was hindered by the cost of batteries and the limitation of recharging only where electric supply was available.

When the first US auto dealership opened in Detroit a few years later, it exclusively sold electric cars. In Austria, Ferdinand Porsche’s early designs also relied on electricity. His partner, Ludwig Lohner, favored electric drives due to the already high pollution from petrol engines in Vienna. However, the availability of cheap oil and improved rural roads led to the dominance of gasoline-powered vehicles. Electric vehicles disappeared by the end of the 1930s.

In Normal, Illinois, I met a man with a unique vision for reviving electric vehicles. In 2015, Mitsubishi closed its auto plant in the area, resulting in the layoff of nearly 1,300 workers. Two years later, engineer and entrepreneur Robert “RJ” Scaringe repurposed the vacant space to establish a factory for his startup, Rivian.

Scaringe, a slim man in his late 30s, with an unassuming demeanor, was seen standing in line at the cafeteria on a day when his company’s value was nearly $28 billion.

Even as a Florida teenager working on Porsches in a neighbor’s garage, Scaringe was determined to build cars. During his time at MIT, where he obtained a doctorate in mechanical engineering, his concerns about climate change became a major focus.

As we toured the old Mitsubishi plant before Rivian’s new vehicles went into production, Scaringe described his mission as finding a way to transition approximately 90 to 100 million cars to electric power.

Scaringe chose to focus on designing electric vehicles that consumers would desire. What do consumers desire most? Some of the least fuel-efficient vehicles on the road. There are now over 200 million SUVs worldwide, six times more than a decade ago, and millions more trucks.

In the US, together they accounted for 70 percent of the new-vehicle market in 2019. “Not only is it the biggest problem in terms of carbon and sustainability… but they’re also the most popular vehicle type,” Scaringe remarked .

Rivian’s first two electric vehicles, a short-bed pickup named the R1T and an SUV called the R1S, will provide environmentally friendly options for outdoor enthusiasts. Similar to Tesla, the company is establishing its own dedicated charging network: 3,500 fast chargers on highways, and thousands more in state parks and near trailheads.

Scaringe felt compelled to do so. While most charging occurs at home, he explained that a patchy and inconsistent charging network complicates long trips and remains “a reason for someone not to buy the vehicle.”

Rivian won’t be the only player in the truck market. Tesla has unveiled its Cybertruck, and an electric version of Ford’s F-150, the most popular vehicle in America with annual sales approaching 900,000 in 2019, is expected in 2022.

The base price for the F-150 Lightning will be considerably lower than Rivian’s high-end vehicles. Within a month of its debut, over 100,000 customers had made reservations.

Ford is an investor in Rivian, and Scaringe is optimistic about the competition; he is quick to emphasize that a complete shift to electric vehicles cannot be achieved by any single company. However, he and his team also recognize that our relationship with vehicles is changing in ways that could support the adoption of electric vehicles.

“Fifteen years ago, if we wanted bananas, we’d go to the store. If I wanted new shoes, I’d drive to the store,” he stated. Now, deliveries bring books, meals, groceries, and shoes to our door. Others make trips for us. In that, Scaringe sees an opportunity.

What if he could convert a fleet of delivery trucks to electric vehicles? “You may, as a customer, not yet choose to switch to electric for your personal vehicle. But because you’re outsourcing a significant portion of your last-mile logistics, you will now be transitioning to electricity whether you realize it or not.”

Rivian is producing 100,000 electric delivery vehicles for Amazon, the retail giant. Some are currently being tested on the streets. FedEx has also announced its plan to go electric. UPS has taken a stake in another electric vehicle company and is purchasing 10,000 electric delivery vans .

Scaringe is considering the developing world, where few individuals own new cars and trucks, and the relationship with vehicles is fundamentally different. He anticipates the emergence of new user models there, such as partial ownership, flexible leasing, and subscription services.

Rather than witnessing the spread of new gas-powered vehicles in regions like Africa and India, he believes the solution is to innovate on the product, business model, and ecosystem to enable these markets to bypass the inefficient and dirty transportation systems seen in the US , Europe, and China.

In Nairobi’s industrial district, warehouses house various businesses, including a unique venture where employees work on converting old petroleum-powered transit vehicles into electric vehicles and building affordable electric motorcycles, while also providing financing options.

Opibus, a startup aiming to bring electrification to developing countries, is not only converting old petroleum-powered transit vehicles into electric vehicles but also constructing new, inexpensive electric motorcycles.

Wairimu, an engineer at Opibus, emphasizes the opportunity to have a better vision for Africa, where many places lack gas stations and where the majority of vehicles are older ones imported used.

The developing world presents a significant untapped market, which traditional vehicle manufacturers find daunting, according to chief strategist Albin Wilson.

The number of gas- and diesel-powered vehicles in parts of East Africa is roughly doubling each decade, with the majority of vehicles being older ones imported used. Opibus is one of the few organizations trying to lay the groundwork for change, given the lack of focus from major vehicle manufacturers on this emerging market.

Opibus initially created conversion kits for safari companies, then transitioned to building electric motorcycles, which have been well received due to their lower cost for fuel and maintenance.

According to Wilson, many motorcycle owners in the region are primarily interested in whether electrification will improve their livelihoods and help them earn more money.

Similar to promote electrification efforts are taking place in other developing countries, including EV start-ups in Rwanda and Ethiopia, as well as experiments with electric postal vehicles in the Philippines and potential electric buses in the Seychelles.

Wairimu believes that transitioning to electric vehicles could have a significant positive impact on East Africa and the world as a whole, particularly in the face of climate change and its potential threats to agriculture.

The interest in electric vehicles is currently at a peak, with a 55% increase in new EV sales in 2022 compared to the previous year. However, there is still a large number of gasoline cars on the roads, and it is likely to remain so for the foreseeable future.

A growing industry is revitalizing internal combustion vehicles by converting them to electric power, and both the shops and aftermarket community are expanding significantly to meet the increasing demand.

“This is a 1976 BMW 2002 — a really enjoyable car to drive but lacking in power,” according to Michael Bream, CEO and founder of EV West, as reported by CNBC. “This particular customer opted for what we call ‘the whole hog ,’ and is installing the 550 horsepower Tesla drive unit in this car.”

Bream’s shop, located in San Diego, California, is a pioneer in EV conversions and has gained significant popularity, resulting in a four-to-five-year waitlist.

“Being involved in electric cars right now is akin to being involved in computers in the ’90s… We want this shift to sustainable fuels to be engaging and enjoyable for car enthusiasts and automobile culture participants,” explained Bream.

In addition to conversion shops, there is a growing community of DIYers undertaking these projects themselves. While the complexity of electric vehicles can be daunting, 14-year-old Frances Farnam is undeterred. She is working on converting a 1976 Porsche 914, which she acquired three years ago and has been documenting the process on her YouTube channel, Tinkergineering.

“I’ve always wanted an electric car, and my mom has a BMW i3,” said Frances. “I hope that by doing this, I can prove that it’s not too challenging… I’m simply doing this in my backyard with my dad.”

She has recently completed priming the car for paint and is preparing to rebuild it. The 914 internet community has been invaluable in assisting her and her father throughout the entire process.

To learn about working with electrical systems, she took a course with Legacy EV, an electric vehicle aftermarket shop, which taught her the intricacies of performing a conversion.

The aftermarket ecosystem for electric vehicles appears to be expanding, with an array of EV-focused parts available to support individuals like Frances who aspire to build their own electric car. Notably, both Ford and GM offer components for EV conversions, and numerous other companies are entering this space. According to the Specialty Equipment Market Association, a trade organization representing automotive manufacturers and resellers, the number of EV-focused products in the market has grown significantly.

“We began two years ago at SEMA with an EV section at the show,” said Mike Spagnola, president and CEO of SEMA. “It encompassed 2,000 square feet. This past year, it expanded to 22,000 square feet… I’m confident that in the next five years, it will reach 100,000 square feet.”

Can AI aid in the discovery of rare metals such as cobalt and copper for the electrification of global vehicles?

Securing access to rare Earth minerals is a crucial national security concern, given the significant dependence of the entire United States’ economy on minerals, the majority of which have been discovered in China so far.

The Defense Advanced Research Projects Agency (DARPA) has collaborated with a company called HyperSpectral, which utilizes artificial intelligence to analyze spectroscopic data. This could prove instrumental in using satellites or drones to locate minerals that would otherwise be challenging to detect.

HyperSpectral CEO Matt Thereur provided an exclusive interview to Defense One, explaining how the process works. Spectroscopy involves the study of how matter interacts with light or other forms of radiation across different wavelengths.

The unique molecular makeup of a specific mineral or substance emits distinctive solar radiation, serving as a unique identifier.

Previously, the company focused on food safety. Whether it concerns identifying potentially harmful pathogens in large food shipments or detecting a new outbreak of medication-resistant streptococcus, spectroscopy can aid in uncovering bacteria that are imperceptible to the naked eye.

“At present, the existing procedures take a couple of days to distinguish between drug-resistant and drug-sensitive staphylococcus bacteria, as they need to culture the bacteria, apply antibiotics, and observe the response. This is in contrast to our approach, where we typically provide results within a few minutes based on a swab from a wound, rather than several days,” Thereur explained.

How does AI come into play? According to Thereur, “Pure samples do not occur naturally. Nature is a very noisy environment. Therefore, when we construct these models using artificial intelligence, we seek out all the relationships that may be obscured by the noise , such as when one section of the spectrum is influenced by another substance within it.”

Furthermore, there are various types of spectroscopic nesting that are not easily amalgamated into a comprehensive data overview, and this is where AI plays a role. Just as AI-driven transcription and translation are made possible by combining auditory data from human speech with textual data related to the likelihood of specific combinations of letters and words, the same principle could apply to spectroscopic data from diverse sources.

“Understanding the spectrographic response of materials, whether through absorbance, reflectance, Fourier Transform Infrared Spectroscopy, Raman, or surface-enhanced Raman, is crucial for differentiating between various materials,” explained Thereur.

Thereur highlighted that the DEA used a similar technique to distinguish between cocaine originating from different areas of Colombia.

According to Thereur, the cooperative agreement with DARPA is still in its early stages, and the potential Defense Department applications for better material understanding are extensive.

Spectroscopy can be conducted using specific satellites, making it valuable for intelligence collection, such as identifying specific materials used in enemy equipment or vehicles.

The Pentagon is interested in improving access to rare Earth materials and relocating the production of essential weapons and supplies closer to the front lines, reducing reliance on vulnerable supply lines in the Pacific.

“There are numerous applications and use cases for analyzing spectral data. There is a significant amount,” stated Thereur.

A machine learning model can forecast the locations of minerals on Earth and potentially other planets by leveraging patterns in mineral associations. The scientific community and industry are interested in locating mineral deposits to gain insights into our planet’s history and for use in technologies like rechargeable batteries.

Shaunna Morrison, Anirudh Prabhu, and their colleagues aimed to develop a tool for identifying occurrences of specific minerals, a task that has historically been legendary on individual experience and luck.

The team created a machine learning model that utilizes data from the Mineral Evolution Database to predict previously unknown mineral occurrences based on association rules. The model was tested in the Tecopa basin in the Mojave Desert, a well-known Mars analog environment.

The model successfully predicted the locations of geologically important minerals, including uraninite alteration, rutherfordine, andersonite, and schröckingerite, bayleyite, and zippeite.

Additionally, the model identified promising areas for critical rare earth element and lithium minerals, including monazite-(Ce), and allanite-(Ce), and spodumene. The authors suggested that mineral association analysis could be a powerful predictive tool for mineralogists, petrologists , economic geologists, and planetary scientists.

According to the International Energy Forum, between 35 and 194 new mines will be required by 2050 to meet technology and energy demands. These new mines are not small-scale coal mines but major operations related to rare earth metals.

Recognizing that few new mines have been opened in the US over the years, this presents a significant challenge. The methods for identifying geographic locations with potential rare earth metal deposits have not kept pace with the times.

However, the innovative use of AI in mining exploration appears to be changing this. An AI model for rare earth mining is currently undergoing testing and has shown promising results.

One company, KoBold Metals, achieved a major breakthrough using AI in mining exploration by locating a large copper deposit deep beneath the surface in Zambia. This discovery generated significant excitement due to the demand for copper and other rare earth metals.

To keep up with the demand for rare earth metals, such discoveries need to occur multiple times a year. It is hoped that the new AI model for rare earth mining will lead to a surge in these resources.

In this context, AI could potentially serve as both a supplier and consumer of these metals. With substantial investment in these endeavors, it is evident that a solution is needed, and many believe AI will play a crucial role.

The AI Model for Rare Earth Mining

Unlike traditional mining exploration, KoBold has taken a different approach. A key aspect of this approach involves a device that was originally developed to identify dark matter.

When efforts to find dark matter proved unsuccessful, the technologies were repurposed for other applications, including the identification and location of rare earth metals.

In essence, after preliminary research narrows down potential sites, a hole is drilled, sometimes deep below the earth’s surface. The technology is then utilized to identify minute subatomic particles and assess density readings to profile key metals, such as copper, lithium, cobalt, and nickel. AI plays a significant role in mining exploration projects like this.

The scientific principles behind this AI model for rare earth mining have been applied in some unusual situations. For instance, it has been used to uncover ancient Egyptian burial tombs and to identify underground tunnels potentially used for unauthorized border crossings.

The application of AI in mining exploration is a new development and is showing significant potential. KoBold is at the forefront utilizing this technology, receiving substantial financial support from venture capitalists worldwide as well as from governments, including the US If this AI model for rare earth mining consistently delivers results, it has the potential to revolutionize the mining industry.

KoBold, which commenced operations approximately five years ago, recognized the early potential of AI in mining exploration. Rather than abandoning traditional mining exploration practices, the company integrated them with its AI model for rare earth mining. For example, Cessna planes are still used to conductor radar and magnetic readings to investigate potential metal deposits underground, and historical research and ground sampling are also routinely employed. All this information, along with AI drilling data, is combined to create KoBold’s Terrashed, a 3D model that integrates tens of millions of documents and data points to assist in metal discoveries.

In terms of operations, KoBold has made substantial investments, with approximately $2.3 billion already invested in a recent copper discovery in Zambia. The company also controls a significant percentage of ownership in this mine. Additionally, KoBold has secured significant funding from private equity firms in the US and Europe, and has received substantial government support. The US has committed to building a railway in Zambia to facilitate copper exporting for KoBold, and negotiations are ongoing with Zambia regarding ownership rights to the mine.

Assuming KoBold’s AI model for rare earth mining continues to perform well, the company is poised for success. It already has around 60 mining projects in progress, with AI in mining exploration driving future endeavors as well.

One could argue that KoBold’s AI model for rare earth mining emerged at the right time, almost like a chicken and egg scenario. While AI in mining exploration represents a significant advancement, it also contributes to the problem. The energy requirements of AI are substantial, and rare earth metals are essential for developing energy solutions. In addition to their role in consumer goods, rare earth metals are also crucial for power grid solutions and large-scale battery storage facilities necessary for storing wind and solar energies. Moreover, these resources are also needed for advanced weaponry. While AI mining advancements are proving to be timely, they have also fueled the rising demand for rare earth metals.

Assuming KoBold’s copper discovery in Zambia can be effectively mined, it has the potential to generate billions of dollars annually, with revenues projected to persist for decades. However, this is just one mine for a single rare earth metal, and many more will be needed . The use of AI in mining exploration holds promise in addressing this demand. Initial indications from KoBold’s AI model for rare earth mining and its copper discovery support this potential, and this breakthrough couldn’t have come at a better time.

KoBold is not the only mining company embracing big data to facilitate the next wave of discoveries. However, its prominent financiers and focus on metals essential for the green energy revolution are drawing attention to an emerging bottleneck in raw materials that could impede global efforts, including those negotiated at the United Nations Climate Change Conference in Scotland, aimed at creating a less carbon-intensive world.

According to the International Energy Agency, achieving the central goal of the 2015 Paris Climate Agreement to keep global warming “well below” 2 degrees Celsius will necessitate unprecedented growth in the production of commodities like copper, cobalt, nickel, and lithium. These materials are essential for solar panels, wind turbines, power lines, and, most importantly, battery-powered electric vehicles, which are less carbon intensive, especially when powered by renewable energy sources.

In 2040, the IEA predicts that meeting the Paris targets will necessitate over 70 million electric cars and trucks to be sold globally each year, which will require up to 30 times more metals than are currently used in their production.

Transitioning to a sustainable future presents challenges, especially in the near term. While advancements in technology and stricter regulations have reduced the environmental impact of mining, the extraction and processing of metals still pollute water and soil, encroach on habitats, and release pollutants and greenhouse gases.

Emissions associated with the minerals used in green energy technologies are a small fraction of those produced by the fossil fuel-powered systems they aim to replace. With the acceleration of electric vehicle adoption, increased battery recycling could reduce the necessity for new battery metals.

Other solutions under development, such as hydrogen-fueled cars, or yet-to-be-imagined technologies, could share the burden of green transportation. However, analysts emphasize that there is currently no alternative to extracting rocks from the Earth.

Limiting warming to below 2 degrees Celsius using existing technologies will require a “massive additional volume of metals,” according to Julian Kettle, senior vice president of mining and metals at Wood Mackenzie, a global energy consultancy. “There’s simply no way around that. ”

Established in 2018, KoBold derives its name from cobalt, a shiny bluish-silver metal crucial for the performance of lithium-ion batteries that revolutionized consumer electronics in the early 1990s.

These batteries are now used on a larger scale in electric vehicles, and cobalt improves their range, lifespan, and protection against fires by reducing corrosion.

However, its supply is particularly precarious, with nearly 70 percent sourced from the Democratic Republic of the Congo, where a history of labor abuses corruption and has gas the urgency to find deposits elsewhere.

Automakers are also exploring cobalt alternatives due to its high cost, but the limitations of current cobalt-free batteries make it likely that demand for cobalt will increase.

Other metals sought by KoBold could also face shortages. Gerbrand Ceder, a materials scientist at the University of California, Berkeley, believes nickel is at the greatest risk of long-term shortages, partially because it is the most viable substitute for cobalt.

Analysts also anticipate a shortage of copper, which is used in various green technologies, including electric vehicle motors, wiring, and charging infrastructure. A typical battery-powered car uses three times as much copper as traditional vehicles.

These supply constraints have arisen because finding viable metal deposits has become more challenging. This is largely due to the depletion of accessible deposits. In Zambia, Africa’s second-largest copper producer, the ores currently mined were either easily accessible or just below the surface when discovered, according to David Broughton, a geologist with 25 years’ experience in the region who advises KoBold and others.

However, this does not mean that there are no deposits deeper in the earth. The interaction between rocks and fluids that formed them over 400 million years ago occurred deep beneath the surface.

Unlike the oil and gas industry, which has significantly improved its access to hard-to-reach places, mining exploration has not experienced a major technological leap in decades.

As a result, the likelihood of success is very low. According to most industry estimates, fewer than one percent of projects in areas without extensive prior exploration result in commercially viable deposits.

KoBold aims to “reduce the uncertainty of what’s under the surface,” according to Josh Goldman, the company’s chief technology officer. Enhanced data application and advancements in artificial intelligence are crucial for improving the odds of success.

AI techniques, including automation and machine learning, have already aided the fight against climate change by enabling better tracking of emissions, more advanced climate modeling, and the development of energy-saving devices such as smart grids.

While AI applications in mining have mainly focused on improving extraction from existing operations, there is a growing trend in using them to assist in the search for new deposits.

Today, companies ranging from tech giants like IBM to specialized firms like Canada’s Minerva and GoldSpot offer AI tools or services tailored to exploration. KoBold, however, is one of the few companies that invests its own capital in projects, including its ventures in Zambia and other locations in Canada, Greenland, and Western Australia.

The company’s impressive technology includes two complementary systems. Connie Chan, a partner at the venture capital firm Andreessen Horowitz, which invested in KoBold in 2019 along with Gates’ Breakthrough Energy Ventures, compares the first system to a “Google Maps for the Earth’s crust and below.”

Creating this technology is like a treasure hunt in geology. KoBold not only gathers its own data from rock and soil samples, as well as measurements such as gravity and magnetism taken from a helicopter, but it also twinned historical records using machine learning tools to extract crucial information from old maps and geological reports, some of which can be millions of pages long.

In some cases, KoBold forms partnerships with established mining companies, such as BHP, the world’s most valuable mining firm, in Australia, which provide their own data.

KoBold utilizes this information to develop and train a set of analytical tools called “machine prospector.” While these tools don’t directly uncover metals, they can provide geologists with better guidance on where to search, or where not to search.

One specific tool used by KoBold in Zambia helps identify mafic rock, which can mislead explorers into thinking they’ve found copper, thereby preventing costly failed drilling.

Another tool, currently in use in northern Quebec where KoBold hopes to find nickel, copper, and cobalt, assists its research team in identifying the most promising rock outcroppings for sampling, expediting the search. “You can actually get through an area of a couple hundred square kilometers in a season,” says David Freedman, a KoBold geologist who spent last summer traversing the tundra.

How effective will machine learning be?

Machine learning tools developed by KoBold and others have already simplified the lives of geologists; as Freedman points out, there’s no wind, rain, or mosquitoes when planning a prospecting route from behind a computer. Nevertheless, these methods are still in their early stages, and their potential to lead to major discoveries remains uncertain.

Antoine Caté, a geologist and data scientist at SRK, an international consultancy, believes that machine learning models have the potential to “significantly enhance” success rates in exploration, partly due to their ability to detect patterns among datasets with more variables than the human brain can process.

However, he warns that such tools are only as effective as the data fed into them: If an algorithm is built with poor data, it will be ineffective at best and could lead prospectors astray at worst.

AI does not eliminate the need for human creativity. “These tools are exceptional for diagnostics,” Caté says. “But ultimately, you still need a skilled individual to interpret the information and draw conclusions from it.”

KoBold’s Goldman shares this view. He emphasizes the importance of robust data, explaining that KoBold’s thorough investigative work reflects this need. Nevertheless, he acknowledges that it may take time for the company’s technology to deliver on its potential, and the extent to which it could accelerate the discovery of deposits is uncertain.

Chan, whose firm has supported tech giants like Airbnb and Instagram, is optimistic about the future. She believes that the challenges faced by the mining industry in exploration and the urgency to find more battery metals make a software-driven approach long overdue. “If anyone can demonstrate they are more effective at selecting the right places to explore, that’s incredibly valuable.”

Even if machine learning techniques prove successful, it may not be sufficient to avert future shortages. Better exploration is just one aspect of the equation: To achieve the two-degree goal of the Paris Agreement, Wood Mackenzie estimates that the mining industry will need to invest over $2 trillion in mine development over the next 15 years—a substantial increase from the approximately $500 billion committed in the previous 15 years.

Scaling up will also require action from governments. Kettle points out that policymakers often stimulate demand for green technologies while simultaneously enacting regulations that make it more challenging to mine the materials needed to power them.

In Zambia, embracing the green energy revolution is a national priority. The new government, elected in August, aims to revitalize an economy burdened by debt. Minerals, which make up three-quarters of exports, are crucial to this effort.

Minister of Mines, Paul Chanda Kabuswe, believes that the potential “looming boom” in battery metals could bring immense benefits to Zambia. However, major deposits have not been discovered in decades. To ensure a stable supply in the long term, the mining industry will need to improve its methods.

Humphrey Mbasela, a Zambian geologist assisting KoBold in analyzing the soil in Mushindamo District, believes that a big data approach will be beneficial. He thinks that explorers have been too focused on surface-level searches, while the most valuable resources may lie deeper.

“After a day of collecting samples in the woods and fields, I can confidently say that the resources are there, hidden underground and waiting to be uncovered,” Mbasela explains.