he artificial intelligence helped the chip company Nvidia achieve excellent business figures. The chip company is the largest provider of specialized chips for computing-hungry AI applications.

The AI boom is causing chip company Nvidia’s business to grow explosively. In the last quarter, the Silicon Valley company doubled its sales year-on-year to $13.5 billion. Profits jumped from $656 million to just under $6.2 billion, which corresponds to 5.7 billion euros.

Chips and software from Nvidia are particularly suitable for applications based on artificial intelligence. The chip company is the largest provider of specialized chips for computing-hungry AI applications such as ChatGPT from OpenAI. That’s why the demand for Nvidia products is currently correspondingly high. Management expects a further increase in sales to around $16 billion for the third quarter, which runs until the end of October.

Analyst Harlan Sur from the US bank JP Morgan comments that the expansion of generative artificial intelligence (AI) and significant language and translator models further drives the demand for the chip manufacturer’s network platforms and software solutions. Current Nvidia figures also support the stock exchanges in Asia and Germany today.

In the same league as the tech giants

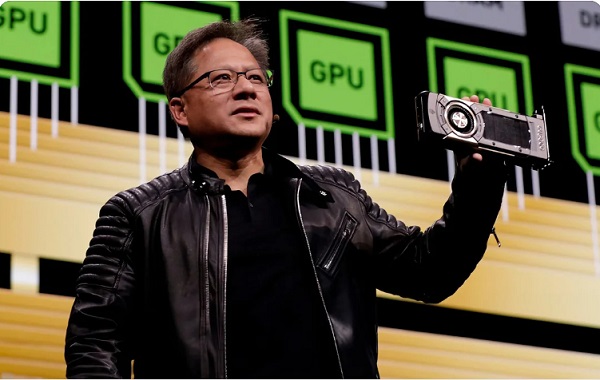

CEO Jensen Huang spoke of a change in the computer industry toward accelerated computing processes and generative AI. Analysts estimate that demand for Nvidia’s chips from this sector exceeds supply by at least 50 per cent. This imbalance is, therefore, likely to persist in the coming quarters. Competitor AMD hmarket share from Nvidia in the coming year. However, according to experts, Nvidia’s CUDA software is years ahead of AMD’s ROCm variant.

This is also reflected in the company’s market value. At the end of May, Nvidia reached a market value of more than a trillion dollars. The price of the share has already tripled this year. This brought the company into the exclusive circle of companies with a market capitalization of more than a trillion dollars.

Otherwise, only the technology group Apple, the software giant Microsoft, the online trading giant Amazon, Google’s parent company Alphabet, and the Saudi Arabian oil company Aramco have such a market value.

Nvidia depends on functioning supply chains.

The chip company has spoken out against tightening US restrictions on semiconductor deliveries to China. CFO Colette Kress said the current measures served their purpose. At Nvidia, revenue from China accounted for between 20 and 25 per cent of its data center business in the last quarter .

Given the global demand, Nvidia does not expect any immediate significant losses even if further possible restrictions are imposed. However, long-term, this will destroy the US chip industry’s opportunities in the vast Chinese market.

Nvidia does not produce its chips but develops them and outsources manufacturing to other companies. Therefore, Nvidia is heavily dependent on functioning supply chains.

“A long-term change”

Nvidia was founded 30 years ago by US-Taiwanese Jen-Hsun “Jensen” Huang. The company initially focused on graphics cards that offered computer gamers better-resolution images. High-performance microchips are now also used in the development of artificial intelligence. Huang emphasized that there is currently a “long-term change” in the world’s data centers from classic processors to the chip architectures offered by Nvidia.

These chips are “more difficult to get than drugs,” said technology billionaire Elon Musk, who recently founded his own company to develop artificial intelligence, xAI.

There are only four companies globally valued at over $2 trillion. These include Apple, Microsoft, the oil company Saudi Aramco, and, as of 2024, Nvidia. If you’re unfamiliar with Nvidia, it’s understandable, as the company does not produce a popular consumer product like Apple. Nvidia specializes in designing chips that are embedded deep within computers, focusing on a seemingly niche product that sees increasing reliance.

In 2019, Nvidia’s market value stood at around $100 billion. Its rapid ascension to a size 20 times that was largely fueled by one factor—the AI craze. Nvidia has emerged as a major beneficiary in the AI industry. For comparison , OpenAI, the maker of ChatGPT, which propelled this obsession into the mainstream, is currently valued at approximately $80 billion. According to research from Grand View Research, the entire global AI market was valued at slightly below $200 billion in 2023, both of which are small in comparison to Nvidia’s worth. With all attention focused on the company’s remarkable evolution, the prevailing question is whether Nvidia can maintain its dominant position. Here’s how the company reached this pinnacle.

Back in 1993, long before the widespread presence of AI-generated art and entertaining AI chatbots on our social media feeds, a startup was founded by three electrical engineers in Silicon Valley. This startup was focused on an exciting and rapidly growing segment in personal computing : video games.

Nvidia was established to develop a specific type of chip known as a graphics card, also referred to as a GPU (graphics processing unit), responsible for producing intricate 3D visuals on a computer screen. The quality of visuals rendered on a computer depends on the performance of the graphics card, a critical component for activities such as gaming and video editing. In its pre-IPO prospectus in 1999, Nvidia highlighted that its future success would hinge on the continued growth of computer applications reliant on 3D graphics. For the most part of its existence, game graphics were Nvidia’s primary focus.

Ben Bajarin, CEO and principal analyst at the tech industry research firm Creative Strategies, acknowledged that until recently, Nvidia had been “relatively isolated to a niche part of computing in the market.”

Nvidia became a dominant player in the realm of video game cards—an industry that generated over $180 billion in revenue last year. However, the company recognized the importance of diversifying beyond gaming graphics card production. While not all of its endeavors were successful, Nvidia’s attempt over a decade ago to establish itself as a major presence in the mobile chip market proved futile. Presently, Android phones utilize a variety of non-Nvidia chips, while iPhones are equipped with Apple-designed ones.

However, another initiative not only proved successful, but also became the reason behind Nvidia’s current prominence. In 2006, the company introduced a programming language called CUDA, which effectively harnessed the capabilities of its graphics cards for general computing tasks. This enabled its chips to efficiently handle tasks unrelated to rendering game graphics. It turned out that graphics cards were even better at multitasking than the CPU (central processing unit), often described as the central “brain” of a computer.

This made Nvidia’s GPUs ideal for computation-intensive tasks such as machine learning and crypto mining. 2006 coincided with Amazon’s launch of its cloud computing business, and Nvidia’s foray into general computing coincided with the burgeoning presence of massive data centers across the globe.

Nvidia has entered the league of tech giants known as the “Magnificent Seven”

Nvidia’s current status as a powerhouse is particularly noteworthy because for a significant part of Silicon Valley’s history, another chip-making behemoth, Intel, held a dominant position. Intel produces both CPUs and GPUs, along with other products, and manufactures its own semiconductors. However, due to several missteps, including delays in investing in the development of AI chips, the rival chipmaker’s preeminence has waned to some extent. In 2019, when Nvidia’s market value was slightly over $100 billion, Intel’s value was twice that amount. Now, Nvidia has joined the league of prominent tech stocks identified as the “Magnificent Seven,” a select group of tech stocks with a combined value surpassing the entire stock market of numerous affluent G20 countries.

Gil Luria, a senior analyst at the financial firm DA Davidson Companies, noted, “Their competitors were asleep at the wheel.” “Nvidia has long talked about the fact that GPUs are a superior technology for handling accelerated computing.”

Nvidia currently serves four primary markets: gaming, professional visualization (such as 3D design), data centers, and the automotive industry, providing chips for self-driving technology. A few years ago, gaming accounted for the largest portion of revenue at about $5.5 billion, surpassing the data center segment which generated approximately $2.9 billion.

However, with the onset of the pandemic, people spent more time at home, leading to increased demand for computer parts, including GPUs. In the fiscal year 2021, Nvidia’s gaming revenue surged by an impressive 41%, while data center revenue experienced an even more remarkable increase of 124%. By 2023, the revenue had grown by 400% compared to the previous year. tested, data centers have surpassed gaming in revenue, even during a gaming boom.

When Nvidia went public in 1999, it had 250 employees. Now, it boasts over 27,000 employees. Jensen Huang, Nvidia’s CEO and co-founder, currently possesses a personal net worth of around $70 billion, signifying an increase of over 1,700% since 2019 .

Chances are, you have encountered Nvidia’s products without even realizing it. Older gaming consoles like the PlayStation 3 and the original Xbox featured Nvidia chips, while the current Nintendo Switch utilizes an Nvidia mobile chip., additionally many mid- to high-range laptops come Equipped with Nvidia graphics cards.

With the surge in AI technology, the company aims to play a more pivotal role in people’s daily tech usage. For instance, Tesla cars’ self-driving feature and major tech companies’ cloud computing services leverage Nvidia chips, serving as a backbone for various daily internet activities, such as streaming content on Netflix or using office and productivity apps. OpenAI utilized tens of thousands of Nvidia’s AI chips to train ChatGPT.

Many people underestimate their daily reliance on AI, not realizing that some of the automated tasks they depend on have been enhanced by AI. Popular apps and social media platforms like TikTok, Instagram, X (formerly Twitter), and even Pinterest offer various AI functionalities Slack, a widely used messaging platform in workplaces, recently introduced AI capabilities to generate thread summaries and recaps of Slack channels.

Nvidia’s chips continue to sell out quickly due to high demand. However, substantial demand allows the company to charge awkwardly high prices for its chips. The chips used for AI data centers can cost tens of thousands of dollars, with top-of-the- line products occasionally selling for over $40,000 on platforms like Amazon and eBay. Notably, last year, some clients faced up to an 11-month wait for Nvidia’s AI chips.

Nvidia’s gaming business is thriving, and the price gap between its high-end gaming card and a similarly performing one from AMD continues to widen. In its last financial quarter, Nvidia reported a gross margin of 76%, meaning it cost them just 24 cents to make a dollar in sales. In contrast, AMD’s most recent gross margin was only 47%.

Advocates of Nvidia contend that its leading position is warranted due to its early investment in AI technology. They argue that Nvidia’s chips are worth the price due to their superior software and the extensive AI infrastructure built around Nvidia’s products. Nevertheless, Erik Peinert, a research manager and editor at the American Economic Liberties Project, suggests that Nvidia has benefited from TSMC, the world’s largest semiconductor maker, struggling to meet demand.

Furthermore, a recent report from The Wall Street Journal hinted at Nvidia wielding its influence to maintain dominance. The CEO of an AI chip startup named Groq alleged that customers feared Nvidia would retaliate with order delays if they sought other chip makers.

While it’s indisputable that Nvidia made significant investments in the AI industry earlier than others, its hold on the market is not unassailable. A host of competitors, ranging from smaller startups to well-funded opponents like Amazon, Meta, Microsoft, and Google —each of which currently employs Nvidia chips—are rapidly advancing. Luria notes, “The biggest challenge for Nvidia is that their customers want to compete with them.”

It cannot be denied that Nvidia made significant investments in courting the AI industry well before others caught on, but its dominance in the market is not unassailable. A host of rivals are emerging, ranging from small startups to well-funded adversaries such as Amazon, Meta, Microsoft, and Google, all of which currently utilize Nvidia chips. “Nvidia’s biggest challenge is that their customers are looking to compete with them,” says Luria.

The issue is not just that their customers are seeking a share of Nvidia’s substantial profits—they simply cannot continue to bear the high costs. Luria notes that Microsoft “went from allocating less than 10 percent of their capital expenditure to Nvidia to nearly 40 percent. That is not sustainable.”

Furthermore, the fact that over 70 percent of AI chips are purchased from Nvidia has concern among antitrust regulators worldwide— the EU has recently begun an investigation into the industry for potential antitrust violations. When Nvidia proposed a staggering $40 billion acquisition of Arm Limited in late 2020, a company that designs a chip architecture utilized in most modern smartphones and newer Apple computers, the FTC intervened to block the deal. “It was evident that the acquisition was intended to gain control over a software architecture that the majority of the industry relied on,” says Peinert. “The fact that they wield significant pricing power and face no effective competition is a genuine concern.”

Will the enthusiasm for AI wane? Whether Nvidia will sustain its status as a $2 trillion company— or soar to even greater heights— hinges fundamentally on the enduring interest of both consumers and investors in AI. Silicon Valley has witnessed the emergence of numerous newly established AI companies, but what proportion of them will thrive, and for how long will investors continue to inject funds into them?

The widespread awareness of AI arose because ChatGPT was an easily accessible— or at least, easily-demonstrated-on-social-media— novelty that captivated the general public. However, a significant portion of AI research is still focused on AI training as opposed to what is known as AI inferencing, which involves trained AI models to complete a task, such as the way ChatGPT responds to a user’s query or how facial recognition technology identifies individuals.

While the AI inference market is expanding (and perhaps more rapidly than expected), a substantial portion of the sector is anticipated to continue to devote extensive time and resources to training. For training, Nvidia’s top-tier chips are likely to remain highly coveted, at least for a while. However, once AI inferencing gains momentum, the demand for such high-performance chips may decrease, potentially leading to Nvidia’s primacy slipping.

Several financial analysts and industry experts have expressed caution regarding Nvidia’s stratospheric valuation, suspecting that the excitement around AI may abate and that there may already be an excessive amount of capital being funneled into the production of AI chips. Traffic to ChatGPT has declined since last May , and some investors are scaling back their investments.

“Every major technology undergoes an adoption cycle,” says Luria. “As it gains visibility, it generates tremendous hype. Eventually, the hype becomes excessive, and then it wanes, leading to a period of disillusionment.” Luria anticipates that this will soon happen with AI—although this does not necessarily mean it is a bubble.

Nvidia’s revenue last year amounted to approximately $60 billion, reflecting a 126 percent increase from the previous year. However, its lofty valuation and stock price are not solely based on that revenue, but also on its anticipated sustained growth— for reference, Amazon, with a lower market value than Nvidia, generated nearly $575 billion in sales last year. For some experts, the path to Nvidia achieving profits substantial enough to justify the $2 trillion valuation appears daunting, particularly with the intensifying competition.

There is also the possibility that Nvidia could be hindered by the rapid advancement of microchip technology. Progress in this field has been rapid over the past few decades, but there are indications that the rate at which more transistors can be integrated into a microchip— allowing them to become smaller and more powerful— is slowing. Bajarin suggests that maintaining Nvidia’s ability to offer significant hardware and software enhancements that persuade its customers to invest in its latest AI chips could pose a challenge.

Despite potential challenges, it is likely that Nvidia will soon achieve the same level of recognition as Apple and Google. The reason for Nvidia’s trillion-dollar valuation is the widespread enthusiasm for AI, which in turn is largely driven by Nvidia.

Great expectations for AI

Investing a trillion dollars in something reflects a strong belief in its potential, and Silicon Valley truly believes in the transformative power of AI. In 2018, Google CEO Sundar Pichai famously stated that “AI is one of the most important things humanity is working on. It’s more profound than, I don’t know, electricity or fire.”

It’s universally agreed that fire is crucial. Some might even consider it as humanity’s first groundbreaking invention. However, tech leaders like Pichai believe that the potential of achieving effectiveness, general artificial intelligence is just as revolutionary as the discovery of fire. Following the release of OpenAI’s ChatGPT in November 2022, which revealed the true marvel of large language models (LLMs), a race began to emerge as to which company could harness that potential.

Investors hurried to support promising LLM startups such as OpenAI (currently valued at $80 billion or more) and Anthropic (estimated at $18.4 billion). In 2023, AI startups in the US raised $23 billion in capital, and there are over 200 such companies globally that are valued at $1 billion or more.

The significant amount of investment reflects the tech industry’s confidence in the enormous potential growth of the AI market. According to a forecast by PwC, AI could contribute nearly $16 trillion to the global economy by 2030, mainly through significantly improved labor productivity.

Coupled with ample cash reserves held by tech giants, there is fierce competition among them to be at the forefront of AI development. Pichai highlighted on a recent earnings call that “the risk of underinvesting is dramatically greater than the risk of overinvesting,” emphasizing the belief that the AI industry will be worth trillions, with the greatest value going to the early pioneers.

Nevertheless, as generative AI is costly to develop and operate, expenses continue to escalate.

Addressing the costs

OpenAI’s Sam Altman has described OpenAI as “the most capital-intensive startup in history” due to the increasing costs of training ever-larger models. Not only is the cost of developing the models high, but so too is the expense of running them. An analysis estimated that OpenAI began $700,000 in daily expenses to operate ChatGPT, primarily due to the extensive compute-intensive server time. As the usage of ChatGPT and other LLMs increases, these costs escalate further.

While Silicon Valley may not have originated the saying “you have to spend money to make money,” it certainly adheres to it. However, the revenue generated from these companies, mainly through subscriptions to their premium models, only covers a fraction of their expenses According to The Information, OpenAI could incur losses as high as $5 billion this year, nearly 10 times the amount lost in 2022.

This trajectory is concerning, as are the user numbers for ChatGPT. Tech analyst Benedict Evans recently highlighted that although many individuals and companies experiment with AI services like ChatGPT,fewer continue to utilize them. Notably, the usage of ChatGPT appears to decrease significantly during school holidays, indicating the user demographics.

Impressive as the capabilities of LLMs may be, particularly when compared to what was deemed feasible a decade ago, the promises of artificial general intelligence that could replace entire workforces have yet to materialize. Currently, the industry seems to face a common Silicon Valley issue: a lack of product-market fit. Chatbots are not yet a fully developed product, and the potential market size for them remains uncertain. This is why experts, ranging from Wall Street banks such as Goldman Sachs to tech venture capital firms like Sequoia Capital, have expressed concerns about the AI industry, and it appears that investors are beginning to take notice.

Nevertheless, this is not to suggest that AI lacks revolutionary potential or that the industry will not ultimately fulfill those lofty aspirations. The dot com crash in the early 2000s was partly due to the overinvestment and overvaluation of startups at the time, yet what remained paved the way for today’s tech giants like Google and Meta. The same could one day be true for AI companies. However, unless the financial performance improves, it might not be these AI companies that will ultimately succeed.

Is Nvidia stock too highly valued?

When a fan requested Nvidia CEO Jensen Huang to autograph her chest earlier this month, that might have indicated that the excitement around the chipmaker might have reached unsustainable levels.

In recent years, Nvidia’s computer chips — which possess certain technical features that make them well-suited for AI applications — propelled the company to new levels of profitability. Nvidia briefly held the title of the world’s most valuable company last week; however, it lost that position a few days later during a days-long sell-off of its shares. While there has been some recovery in its stock price since then, it is currently the world’s third most valuable company with a market capitalization of $3.1 trillion, after Microsoft and Apple.

The sell-off occurred amid concerns that Nvidia might be overvalued. Financial research strategist Jim Reid of Deutsche Bank recently cautioned about “signs of over-exuberance” regarding Nvidia, and some of Nvidia’s executives have even sold off some of their stake in the company .

Despite the concerns, there are still numerous reasons to be optimistic about Nvidia: The company has established itself as a leading chipmaker in the industry, benefiting from an early bet on AI that has paid off as AI applications like OpenAI’s ChatGPT have brought broader public attention to the technology.

“It’s still early in the AI competition,” said Daniel Newman, CEO of the Futurum Group, a tech research and analysis firm. “But virtually everyone who has been developing AI up to this point has likely done at least some of their most important work on Nvidia.”

The stock market has responded accordingly, with Nvidia being a part of the so-called “Magnificent Seven” tech stocks that contributed to a significant portion of stock market growth last year. Its stock price had surged by nearly 155 percent since January as of the market closing on Wednesday.

However, whether Nvidia can maintain such growth depends on advancements in AI and the extent to which businesses will adopt it.

How Nvidia rose to become one of the world’s most crucial chipmakers

Nvidia has long been recognized as the foremost producer of graphics cards for gaming. However, its graphics processing units (GPUs), the primary component of graphics cards, gained popularity during a surge in cryptocurrency mining, a process that involves solving complex mathematical problems to release new cryptocurrency coins into circulation.

This is due to the highly optimized nature of Nvidia GPUs for “parallel processing” — essentially, dividing a computationally challenging problem and assigning its various parts to thousands of processor cores on the GPU at once, solving the problem more quickly and efficiently than traditional computing methods.

estimated, generative AI also relies on parallel processing. Whenever you interact with ChatGPT, for instance, the AI model needs to analyze large data sets — essentially, the world’s text-based online content at the time of ChatGPT’s last knowledge update — to provide you with an answer. Achieving this in real time and at the scale that companies like OpenAI aim for necessitates parallel processing carried out at data centers that house thousands of GPUs.

Nvidia recognized the potential gains from the GPU requirements of generative AI early on. Huang has described 2018 as a “bet the company moment” in which Nvidia reimagined the GPU for AI, well before the emergence of ChatGPT. The company strategically aligned its research and development as well as acquisitions to benefit from the impending AI boom.

“They were playing the game before anyone else,” Newman commented.

In addition to offering GPUs optimized for this purpose, Nvidia created a programming model and parallel computing platform known as the Compute Unified Device Architecture (CUDA), which has become the industry standard. This software has made Nvidia GPUs’ capabilities more accessible to developers.

Therefore, despite Nvidia’s competitors like AMD and Intel introducing similar offerings, even at lower price points, Nvidia has retained the majority of the GPU market share for businesses, partly because developers have grown accustomed to CUDA and are reluctant to switch.

“What [Nvidia] realized very early on is that if you want to dominate in hardware, you need to excel in software,” Newman explained. “Many of the developers who are creating AI applications have established them and feel comfortable creating them using CUDA and running them on Nvidia hardware.”

All of these factors have positioned Nvidia to capitalize on the ever-increasing demands of generative AI.

Can Nvidia sustain its current prosperity?

Nvidia’s competitors are unlikely to pose an immediate threat to its status as an industry leader.

“In the long term, we anticipate tech giants to seek out alternative sources or in-house solutions to diversify away from Nvidia in AI, but these efforts will probably eat into, but not replace, Nvidia’s dominance in AI,” Brian Colello, a strategist for Morningstar, wrote in a recent report.

However, Nvidia’s ability to maintain the level of growth it has experienced in the past year is linked to the future of generative AI and the extent to which it can be monetized.

Access to ChatGPT is currently open to everyone at no cost, but a $20 monthly subscription will provide access to the most advanced version. However, the primary revenue stream does not come from individual subscribers at the moment. Instead, it is derived from businesses. It remains uncertain how companies will incorporate generative AI into their business models in the years to come.

For Nvidia’s growth to be sustainable, it is crucial that major companies such as Salesforce or Oracle, known for selling software to enterprises, develop new software that heavily utilizes AI. This would lead to these large companies signing yearly contracts to gain access to extensive computing power, according to Newman.

“Otherwise, the fundamental concept of establishing large data centers around the world filled with GPUs becomes somewhat risky.”

The decision on whether to invest in Nvidia stock depends on how optimistic you are about the penetration of AI into the economy.”We anticipate that Nvidia’s future will be closely linked to the AI market, for better or worse, over an extended period,” Collelo notes.

Nvidia’s market capitalization exceeded $3 trillion in 2024, driven by the generative AI surge, a recovering tech sector, and a stock increase of 154% that year. Nevertheless, there are concerns about whether AI can maintain the current hype.

Nvidia continues to expand, having crossed the $3 trillion threshold on June 18, 2024, before falling just below that figure by the end of August 2024. By November 2024, Nvidia became the largest publicly traded company in the U.S. in terms of market cap, surpassing Apple with a valuation exceeding $3.6 trillion. During mid-2023, Nvidia reached a market valuation of $1 trillion, overtaking both Amazon and Alphabet, the parent company of Google. Within a span of nine months, the company’s market value escalated from $1 trillion to $2 trillion by February 2024, and it only took an additional three months to reach $3 trillion by June 2024.

Nvidia’s stock has experienced fluctuations. Despite reporting impressive growth figures, Nvidia’s stock dropped by as much as 5% following its second-quarter earnings report in 2024. On November 7, 2024, Nvidia’s stock hit a record high of $148, driven by high demand for its GPUs essential for AI applications. The company’s latest chip, Blackwell, has become so sought-after that it is already preordered and booked out for up to a year. Due to Nvidia’s consistent growth, it is set to replace Intel in the Dow Jones. S&P Global manages the Dow and selects its stocks based on how the industry is likely to influence the U.S. economy.

Nvidia’s ascent was gradual. The tech sector encountered challenges in 2022, but began to recover in 2023, notwithstanding tech layoffs. Generative AI emerged as a primary catalyst for this resurgence, and the stock market is reflecting the signs of recovery. The growth of generative AI triggered a bull market in tech stocks, marking a period of expansion on the stock exchange.

The elite group of tech stocks known as the Magnificent Seven includes Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. The stock prices of the Magnificent Seven companies increased by an average of 111% in 2023, while Nvidia experienced a remarkable rise of 239% that year.

On June 7, 2024, Nvidia executed a 10-for-1 stock split, reducing its stock price from $1,200 to about $120. The new shares commenced trading at adjusted rates after June 10, 2024. Nvidia chose to split its stock to enhance accessibility for employees and investors. This split does not alter the overall value of the company. Thus, a stockholder who possessed a single share prior to the split would receive an additional nine shares afterward. Ultimately, this reduced stock price facilitates easier access for investors. This stock split assisted Nvidia in transitioning into the Dow Jones, as the individual stock price is a crucial factor for the Dow, rather than the total market capitalization of the company.

Despite the daily fluctuations of the stock market, investors are recognizing this growth and speculating on how much AI demand may influence the tech sector in 2024.

The emergence of Nvidia

Nvidia stands among the world’s leading manufacturers of GPUs. Graphics Processing Units (GPUs) are semiconductors or computer chips that conduct mathematical operations to create visuals and images. The GPU accelerates and manages graphical workloads, displaying visual content on devices like PCs or smartphones.

Throughout 2023, Nvidia’s earnings reports consistently outperformed expectations as interest and momentum in AI grew. Nvidia’s advanced chips are capable of processing the vast amounts of data required to train generative AI applications such as ChatGPT and Gemini. As Nvidia had already established dominance in this market prior to the surge in AI interest, its growth continued to accelerate as demand increased.

Nvidia reported $30 billion in revenue for its fiscal second quarter ending July 28, 2024. This figure represents a 15% increase from the previous quarter and a 152% rise from one year earlier. The company also achieved record quarterly data center revenue of $26.3 billion, which was up 16% from the prior quarter and surged 154% compared to the previous year.

To provide context, while companies like Apple and Microsoft invest in AI, Nvidia reaps profits from AI by producing the necessary chips to operate the technology.

As businesses require hardware to handle substantial energy demands along with the wave of AI, these advanced chips are equally crucial for the metaverse, gaming, and spatial computing. Additionally, Nvidia manufactures chips for automobiles as technology continues to evolve.

Key factors contributing to Nvidia’s stock surge

While the growth of generative AI is a major contributor to Nvidia’s rise, other factors have also significantly driven the stock’s increase.

1. The growth of supercomputers

Nvidia’s chips power supercomputers that handle the massive data requirements of this advanced technology. Organizations like Meta utilize supercomputing capabilities for their AI Research SuperCluster computer to train intricate AI models. Furthermore, Tesla is beginning to develop an AI-centric supercomputer for its vehicles.

2. Demand for generative AI

As the demand for generative AI shows no signs of slowing, Nvidia is likely to experience growth with the adoption of each new system. According to Bloomberg Intelligence, the AI industry is projected to expand at a compound annual growth rate of 42% over the next decade. The generative AI market could reach a value of $1.3 trillion by 2032 due to the rising demand for generative AI products.

Nvidia’s A100 GPU chips are essential for training the model used in ChatGPT. Companies like OpenAI, which rely heavily on large datasets for training extensive language models, are rapidly evolving and require more accelerated computing resources. The need for GPUs is expected to increase as these systems train on and assimilate more data.

3. The changing world of the metaverse and XR

Nvidia plays a significant role in the metaverse and the realms of virtual and augmented reality through its Omniverse platform. Nvidia provides 3D modeling software aimed at efficiently streaming extended reality (XR) content. As the metaverse develops, so does the necessity for Nvidia chips to support its operation. Businesses are turning to XR solutions to forge virtual environments for training purposes.

The gaming sector is also a substantial customer for Nvidia’s graphics division. Video games demand more powerful cards to handle high-resolution graphics, particularly as gaming shifts from traditional consoles to cloud platforms. Nvidia’s gaming GPUs, like the GeForce RTX 4070, enable video games to run at superior resolutions and faster speeds.

4. Strategic placement

Nvidia is deeply intertwined with the cryptocurrency sector. Miners utilize its graphics cards to mine tokens, which requires considerable power. The cryptocurrency boom caused a spike in demand for Nvidia’s cards.

Future of Nvidia

Although Nvidia’s processors are foundational to most data centers powering generative AI, there are potential hurdles ahead, including competition from tech giants developing their own AI chips, economic uncertainties, and increasing rivalry.

The generative AI sector is anticipated to keep expanding, but new regulations are likely to emerge that could influence Nvidia’s AI chips. U.S. trade restrictions on advanced semiconductors from China are also affecting Nvidia’s expansion since sales to China represented a significant portion of its data center revenue.

In light of Nvidia’s noticeable growth, competitors are introducing similar chips, such as AMD’s Instinct MI200 line of GPU accelerators. Intel has also rolled out a fifth generation of Intel Xeon processors for data centers. Companies might start to diversify their suppliers instead of relying solely on one vendor, which could hinder Nvidia’s growth.

It’s challenging to foresee whether Nvidia will maintain its growth trajectory. Nvidia has established a strong presence in the AI sector, and if the generative AI market develops as forecasted, its revenue could continue to rise. However, it remains uncertain how much market share Nvidia’s competitors will capture. Even amid increasing competition, Nvidia retains a robust market share, especially after recently announcing its H200 computing platform. Major cloud providers like Amazon, Google, and Microsoft have developed their own AI processors but still rely on Nvidia chips.

Another challenge Nvidia faces is the potential limitation on sales of its advanced AI chips to certain nations for national security purposes.

The market is evolving rapidly. Businesses are keen on adopting generative AI, leading to the emergence of new vendors to fulfill industry demands. New areas such as security and compliance will also reshape the generative AI market in the corporate sector.

Nvidia’s data center business considerably drives its success and has a strong demand for AI infrastructure. Data center revenue accounted for nearly 87% of Nvidia’s overall revenue. Other major tech companies—like Google, Microsoft, and Meta—continue to invest in AI and have reported increased AI spending in their earnings statements. This indicates that even if Nvidia’s stock does not rise as quickly as it has in the past, it doesn’t imply poor performance. The company still experiences growth, and the demand for its products remains robust.

New powerful chips are on the horizon, but there are uncertainties about whether the tech company can maintain its growth.

When Jensen Huang addressed the Nvidia annual general meeting last week, he did not refer to the decline in share price.

The American chipmaker, supported by its vital role in the AI surge, had briefly achieved the status of the world’s most valuable company on June 18, but that title quickly faded. Nvidia lost approximately $550bn (£434bn) from the $3.4tn (£2.68tn) peak market value it reached that week as tech investors combined profit-taking with skepticism about the sustainability of its rapid growth, leading to a slowdown.

Huang, however, spoke as if he were the CEO of a business that transitioned from a $2tn to a $3tn valuation in just 30 days this year – and is now eyeing $4tn.

He characterized an upcoming set of powerful new chips, known as Blackwell, as potentially “the most successful product in our history” and perhaps in the entire history of computing. He also mentioned that the new wave of AI would focus on automating $50tn worth of heavy industry, describing what seemed like an endless cycle of robotic factories coordinating robots that “manufacture robotic products.”

In conclusion, he stated: “We’ve reinvented Nvidia, the computer industry, and very likely the world.”

These are the types of statements that contribute to a $4tn valuation and the AI hype cycle. Nvidia’s shares are gradually increasing, surpassing $3tn this week, as it remains the prime avenue for investing in the AI boom. Is that sufficient to drive it to $4tn despite the emergence of doubts among investors?

Alvin Nguyen, a senior analyst at Forrester, indicated that “only a collapse of the genAI market” would hinder Nvidia from reaching $4tn at some point – but whether it would do so before its tech rivals is another question. Currently, Microsoft – another major AI player – and Apple hold the first and second positions, respectively, in terms of market size, with Nvidia in third.

If OpenAI’s next significant AI model, GPT-5, and other upcoming models are impressive, the share price will remain strong and could reach $4tn by the end of 2025, according to Nguyen. However, if they disappoint, then the share price may be impacted, given its role as a leading figure in the technology sector. A technological advancement could lead to less computational power being necessary to train models, he added, or interest in generative AI tools from businesses and consumers may not be as strong as anticipated.

“There is much that is uncertain and beyond Nvidia’s control that could influence their journey to $4tn,” Nguyen said. “This includes dissatisfaction with new models released, improvements in existing models that decrease computational needs, and weaker-than-expected demand from businesses and consumers for genAI products.”

Private AI research organizations like OpenAI and Anthropic – the companies responsible for the ChatGPT and Claude chatbots – are not publicly traded, leaving substantial sums of money in investors’ accounts with no access to some of the major participants in the generative AI surge.

Investing in multinational corporations like Microsoft or Google is already costly, and only a small part of the investment pertains to the emerging trend. There could be a significant AI boom; however, if, for instance, Google’s search advertising business suffers as a result, the company wouldn’t necessarily benefit overall.

In contrast, Nvidia is providing essential resources during a gold rush. Despite years invested in capacity expansion, it continues to sell its high-end chips faster than they can be produced. A significant portion of investments in advanced AI research flows directly into Nvidia’s accounts, with companies like Meta dedicating billions to secure hundreds of thousands of Nvidia GPUs (graphics processing units).

These chips, which the company specializes in, were originally sold to enhance gamers’ experiences with smooth, high-quality graphics in 3D games – and through a stroke of immense luck, turned out to be precisely what leading researchers required to create large AI systems like GPT-4 or Claude 3.5.

GPUs can carry out complex calculations needed for the training and operation of AI tools, such as chatbots, quickly and in large quantities. Therefore, any company aiming to develop or operate a generative AI product, such as ChatGPT or Google’s Gemini, requires GPUs. The same holds for the deployment of openly available AI models, such as Meta’s Llama, which also necessitates substantial amounts of chips for its training process. In the case of systems termed large language models (LLMs), training involves processing vast amounts of data. This allows the LLM to learn to recognize language patterns and determine what the next word or sentence should be in response to a chatbot inquiry.

Nvidia has not fully captured the AI chip market, however. Google has consistently depended on its proprietary chips, known as TPUs (which stands for “tensor”, an aspect of an AI model), while other companies aim to follow suit. Meta has created its Meta Training and Inference Accelerator, Amazon provides its Trainium2 chips to AWS (Amazon Web Services) customers, and Intel has launched the Gaudi 3.

None of the major competitors are currently challenging Nvidia at the very high end. Nevertheless, competition is not limited to that bracket. A report from the tech news outlet, the Information, has brought attention to the emergence of “batch processing”, which allows businesses to access AI models at a lower cost if they can wait for their requests to be processed during off-peak times. This, in turn, enables providers like OpenAI to invest in more affordable, efficient chips for their data centers instead of solely concentrating on the fastest hardware.

On the opposite side, smaller enterprises are beginning to produce increasingly specialized products that outperform Nvidia in direct comparisons. Groq (which should not be confused with Elon Musk’s similarly named Grok AI, a launch that has led to an ongoing trademark conflict) manufactures chips that cannot train AI at all – but can execute the trained models extremely quickly. Not to be outdone, the startup Etched, which recently secured $120 million in funding, is developing a chip that is designed specifically to run one type of AI model: a “transformer”, the “T” in GPT (generative pre-trained transformer).

Nvidia has to do more than just maintain its position against emerging competition, both large and small; the company must excel to achieve its next benchmark. While traditional market fundamentals are less in vogue, if Nvidia were valued like a conventional, low-growth company, even reaching a $3 trillion market cap would necessitate selling $1 trillion worth of its premium GPUs annually, with a 30% profit margin, indefinitely, as noted by one expert.

Even if the AI sector expands sufficiently to support that, Nvidia’s profit margins could become more difficult to uphold. The company possesses the chip designs necessary to maintain its lead, but the real constraints in its supply chain mirror those faced by much of the industry: at the cutting-edge semiconductor foundries primarily operated by Taiwan’s TSMC, America’s Intel, China’s SMIC, and very few others globally. Notably absent from that list is Nvidia itself, which relies on TSMC for its chips. Regardless of how advanced Nvidia’s chipsets are, if it has to reduce TSMC’s order book to meet demand, the profit will inevitably shift in that direction as well.

Neil Wilson, the chief analyst at Finalto brokerage, pointed out that the bearish perspective on Nvidia – a term in market jargon indicating a prolonged decline in share price – is based on the view that the company’s demand will return to less intense levels after it fulfills its existing orders.

“All their customers have been scrambling to place GPU orders, but that rush won’t last forever,” Wilson remarked. “Clients are likely to over-order and then begin to cancel. It’s a favorable moment now, but it isn’t sustainable.” He envisions Nvidia reaching a valuation of $4 trillion and beyond, but “perhaps not at the current rate”.

Jim Reid, who heads global economics and thematic research at Deutsche Bank, recently circulated a note questioning if Nvidia could be considered “the fastest-growing large company of all time?” He highlighted that Nvidia’s market capitalization surged from $2 trillion to $3 trillion in just 30 days, in contrast to Warren Buffett’s 60 years to bring Berkshire Hathaway close to $1 trillion.

In any case, against the backdrop of sluggish productivity – a gauge of economic efficiency – along with a shrinking workforce and increasing government debt, the economic potential of AI is beneficial, Reid noted.

“If AI serves as the catalyst for a fourth Industrial Revolution, that would be very positive news,” he asserted. “If it doesn’t, markets will ultimately face significant challenges.”

There’s more at stake than merely racing to reach a $4 trillion valuation.

Wall Street is very optimistic about Nvidia’s future earnings

Nvidia has emerged as one of the most sought-after stocks in the artificial intelligence (AI) sector. Its split-adjusted stock price has surged nearly 700% since 2023. However, the stock has experienced a 14% decline since reaching its peak of around $136 per share in June, shortly after completing a 10-for-1 stock split.

One factor contributing to this downturn is the ambiguity surrounding the longevity of AI investment. Investors are seeking evidence that capital expenditures are enhancing revenue growth and productivity. However, the lack of substantial supporting evidence has raised fears about potential cuts to AI budgets.

Another aspect influencing the stock’s decline is the sequential drop in Nvidia’s gross margin in the latest quarter, which could indicate competitive pressures. A number of companies are developing custom AI chips, leading investors to worry that Nvidia might lose its competitive edge in the market.

Nevertheless, Wall Street has optimistic news for Nvidia shareholders regarding both issues. Here are the key points to note.

According to JPMorgan, investments in AI infrastructure are gaining traction. Analysts Jonathan Linden and Joe Seydl from JPMorgan believe that capital expenditures linked to artificial intelligence (AI) infrastructure continue to gather momentum. They project that spending from five major cloud companies—Microsoft, Amazon, Alphabet, Meta Platforms, and Oracle—will grow at an annual rate of 24% over the next five years, an increase from the previous 15% yearly growth rate.

Furthermore, Linden and Seydl predict that AI will demonstrate a noticeable impact on productivity by the end of the decade. While this may seem far off, they argue that the time gap between technological advances and productivity improvements is actually decreasing. “Consider this: it took 15 years for personal computers to enhance the economy’s productivity. AI could achieve this in just seven years.”

The International Data Corp. anticipates that artificial intelligence will contribute $4.9 trillion to the global economy by 2030, rising from $1.2 trillion this year. In this scenario, AI would represent 3.5% of global GDP by the end of the decade. The implications of this forecast are significant: investments in AI are not only valuable but also essential for companies that wish to remain competitive.

Skeptics will likely dismiss AI as an exaggerated technology in the coming years, similar to the opinions some held about the internet during the 1990s. AI stocks could face a substantial decline at some point, akin to what internet stocks experienced in the early 2000s. However, history may vindicate the skeptics, leading to a potential rise in Nvidia’s share price. In fact, Beth Kindig from the I/O Fund believes Nvidia could achieve a valuation of $10 trillion by 2030.

Morgan Stanley asserts that Nvidia’s rivals consistently fall short. Nvidia produces the most renowned graphics processing units (GPUs) in the computing industry. Last year, the company was responsible for 98% of data center GPU shipments, and its processors set the benchmark for accelerating AI tasks. Nvidia holds more than 80% market share in AI chips, with Forrester Research recently stating, “Without Nvidia GPUs, modern AI wouldn’t be feasible.”

The surge in demand for AI infrastructure has naturally attracted more competitors to the field. This includes chip manufacturers like Intel and Advanced Micro Devices, along with major tech firms such as Alphabet, Amazon, and Apple. Each of these companies has developed alternative GPUs or custom AI accelerators. Nonetheless, CEO Jensen Huang expresses confidence that Nvidia chips provide the “lowest total cost of ownership,” suggesting that cheaper alternatives may incur higher total costs once associated expenses are factored in.

Despite this, Nvidia will likely lose some market share as custom AI accelerators gain popularity in the coming years. However, losing a fraction of market share does not equate to losing market leadership. Nvidia’s superior hardware, combined with its extensive ecosystem of support software for developers, creates a strong competitive advantage that rivals struggle to overcome.

Analysts at Morgan Stanley recognized this sentiment in a recent report. “Since 2018, we have encountered numerous challenges to Nvidia’s dominance—from about a dozen start-ups to several initiatives from competitors like Intel and AMD, and various custom designs. Most of these attempts have fallen short. Competing with Nvidia, a company that spends $10 billion annually on R&D, is a formidable challenge.”

Wall Street is very optimistic about Nvidia’s future earnings. Out of the 64 analysts tracking the company, 94% have a buy rating on the stock while the remaining 6% maintain a hold rating. No analysts are currently recommending selling the stock. Nvidia has a median price target of $150 per share, suggesting a 29% increase from its current price of $116, based on CNN Business data.

Looking ahead, Wall Street analysts foresee Nvidia’s earnings growing at an annual rate of 36% over the next three years. This consensus forecast makes the current valuation of 54 times earnings appear quite reasonable. These projections yield a PEG ratio of 1.5, a significant discount compared to the three-year average of 3.1. This is promising news for potential investors.

Nvidia stands out from its rivals due to its significant technological advantage. Its products are often unmatched and play a crucial role in AI infrastructure. This unique position allows Nvidia to price its offerings and services at a premium.

Although competitors are working on their own AI chips and resources, Nvidia is fostering strong partnerships with major tech firms. The company continues to introduce innovative chip designs, ensuring it stays ahead of the curve. Even as large tech companies develop their own AI hardware, they still collaborate with Nvidia, which remains a leader in a rapidly expanding industry.

Nvidia serves as an entry point into an industry that feels as groundbreaking as the internet. Tech leaders are unlikely to pass up such a lucrative opportunity, even if it comes with a steep entry cost.

Increasing Demand

Monitoring the forecasts from other AI companies can provide insights into Nvidia’s future trajectory. Super Micro Computer (SMCI), a partner of Nvidia, has also gained from the surge in AI demand, and its outlook for Fiscal 2025 is promising for Nvidia shareholders.

In Fiscal 2024, Super Micro reported $14.94 billion in revenue and anticipates that Fiscal 2025 revenues will fall between $26.0 billion and $30.0 billion. After more than doubling its revenue year-over-year in Fiscal 2024, the company is projected to achieve similar results in Fiscal 2025. Additionally, it stated that a delay with Nvidia’s Blackwell will not significantly affect its sales.

Growing demand for Super Micro’s AI offerings suggests that Nvidia will see strong growth in demand in the near future. Nvidia has also released positive earnings forecasts that indicate further growth prospects for long-term investors.