Global sales of smartwatches have experienced a decline for the first time, new data reveals, largely driven by a significant drop in the popularity of the leading brand, Apple.

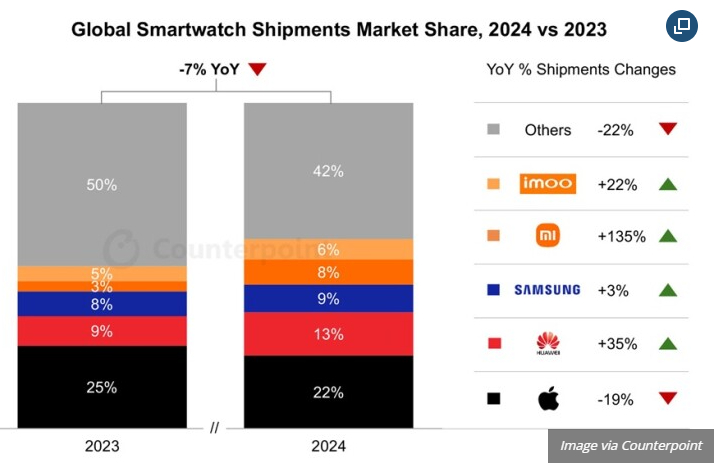

According to market research firm Counterpoint, shipments of these devices decreased by 7% in 2024 compared to the previous year.

Apple Watch shipments decreased by 19% during that time period, as reported by Counterpoint.

The firm attributes this decline to a lack of new features in Apple’s recent devices and the absence of a rumored high-end Ultra 3 model.

“The primary cause of the decline was North America, where the lack of the Ultra 3 and minimal upgrades in the S10 series led consumers to delay purchases,” stated Counterpoint senior research analyst Anshika Jain.

In late 2023 and early 2024, Apple also faced sales and import restrictions in the US due to a disputed patent related to blood oxygen monitoring, which contributed to the lower sales figures in the early part of 2024, according to Ms. Jain.

Apple’s market share slipped to 22% in the last quarter of 2024, down from 25% the year before.

Despite the overall downturn, the previous year saw a significant increase in smartwatch sales for Chinese brands such as Xiaomi, Huawei, and Imoo.

Sales within China also rose from 19% of the global market to 25% from the last quarter of 2023.

This marked the first instance where China surpassed India and North America in smartwatch sales, according to Counterpoint.

“Huawei, Imoo, and Xiaomi were the leaders in the Chinese market,” noted Ms. Jain.

The Chinese brands also tapped into a growing trend: the rising popularity of smartwatches for children, which was the only market segment to see growth in 2024.

Imoo, known as “Little Genius” in China, focuses on children’s smartwatches and recorded a 22% increase in shipments.

“The segment of kids’ smartwatches is gaining popularity as parents prioritize their children’s safety and want to track and stay connected with them,” said Balbir Singh from Counterpoint.

However, Imoo’s growth was overshadowed by a remarkable 135% increase in shipments from Xiaomi.

Xiaomi’s Smart Band activity trackers are offered at a much lower price point than those from Apple and Samsung.

Another significant factor contributing to the global sales decline was India, where its market share fell from 30% to 23%.

Counterpoint anticipates a slight recovery with “single-digit percentage growth in 2025.”

It expects the increase in sales to be fueled by the growing adoption of AI features and a stronger focus on providing a broader range of health data.

Analytics firm Counterpoint Research released its latest report on global smartwatch shipments in Q4 2024, indicating that for the first time, shipments declined (by 7%). Apple, despite seeing a year-over-year drop of 19%, maintained its top position in global shipment market share.

The report suggests that Apple’s downward trend is mainly due to increased competition and less compelling upgrade cycles. This is especially surprising given that the Apple Watch recently celebrated its 10th anniversary with the Series 10.

Several factors are contributing to this decline. The absence of the Apple Watch Ultra 3 and minimal feature updates in the Apple Watch Series 10 significantly influenced North American customers to postpone purchases, where Apple suffered the most.

Additionally, Apple has not updated the Apple Watch SE, which has further contributed to the decline. With the launch of the iPhone 16e, the future of the SE line appears uncertain.

Counterpoint’s statistics support previous reports indicating that Apple is on a downward trajectory, shipping around 800,000 fewer smartwatches. The company also faced a patent conflict with Masimo last year, which led to the banning of the blood oxygen monitoring feature in the US. Recently, Apple avoided an import ban related to a different patent dispute with AliveCor.

The report highlights that the section for children’s smartwatches is the only one experiencing growth, with Imoo leading the market thanks to its affordable and feature-rich products. More parents are concerned about tracking their children and maintaining constant communication with them.

Samsung reported a 3% year-over-year increase in global shipment share, driven by the successful adoption of its Galaxy Watch7, Galaxy Watch Ultra, and Galaxy Watch FE. The South Korean company collaborated with Google to introduce a child-friendly experience for the Galaxy Watch7.

In terms of regional performance, China has for the first time emerged as the leading market share holder in global shipments, outpacing North America and India, according to the report. Huawei, Xiaomi, and BBK (Imoo) were among the major players in the Chinese market.

The global smartwatch market is projected to recover gradually in 2025, anticipating single-digit growth. Both Android and iOS smartwatches are likely to incorporate more AI features and advanced sensors to provide deeper insights into health data, focusing on serious health metrics like heart health tracking, atrial fibrillation, sleep apnea, hypertension, and diabetes.

India’s Smartwatch Market Sees 30% YoY Decline In 2024

India’s smartwatch shipments experienced a 30% decline year-on-year in 2024, representing the first significant slowdown in the market after years of steady growth, according to Counterpoint Research’s Q4 2024 India Smartwatch Shipment Tracker.

This decline was attributed to a slower replacement cycle, mainly due to limited differentiation in lower price segments, a lack of innovation, poor sensor accuracy, and a confusing product lineup that made purchasing decisions more complicated. Many first-time buyers reported being dissatisfied with their initial smartwatch experiences, which further suppressed demand. Additionally, price competition and a decrease in new users contributed to the drop in both value and quantity.

Despite this downturn, analysts are optimistic that the slowdown is temporary, as smartwatch adoption rates in India are still comparatively low. The market is currently in a phase of correction, prompting OEMs to reevaluate their strategies.

As noted by Senior Research Analyst Anshika Jain, manufacturers are prioritizing improving user experiences, incorporating advanced features like NFC, GPS, and cellular connectivity, and shifting their focus toward higher price categories. Furthermore, brands are targeting new demographics, such as the kids’ smartwatch market.

The premium smartwatch segment, priced at Rs 20,000 and above, contradicted the overall market trend by achieving a 147% year-on-year increase. This growth was fueled by seasoned users upgrading to advanced smartwatches that provide superior health insights, improved smartphone integration, and high-end features. Apple, Samsung, and OnePlus emerged as the key players in this premium segment.

Market-wise, Noise led with a 27% share, followed by Fire-Boltt with 19%.

Titan, the parent company of Fastrack, was the only major player to register growth, with a 35% rise year-on-year, while Boult’s performance remained consistent. CMF by Nothing witnessed over a 5x increase with its Watch Pro 2, and realme made a return with the Watch S2.

In terms of sales channels, online platforms maintained a dominant presence, accounting for 66% of the market. Nevertheless, offline retail also grew as OEMs enhanced their partnerships and expanded their visibility in brick-and-mortar stores.

Looking ahead, Research Analyst Balbir Singh pointed out that as consumer awareness of health tracking and sensor accuracy increases, there will likely be a greater demand for high-quality smartwatches that improve user experiences. He stressed the importance for brands to regain consumer trust in the category to stimulate demand.

Singh anticipated a slight single-digit percentage drop in the smartwatch market in 2025. He also observed that while the market previously welcomed numerous new entrants each quarter, intense competition and decreasing profit margins would probably restrict the arrival of new players in the next year.

“Established OEMs are expected to shift their focus to higher price segments as they aim to restore their margins. The premium segment is likely to continue its growth due to its aspirational status and overall superior devices,” Singh concluded.