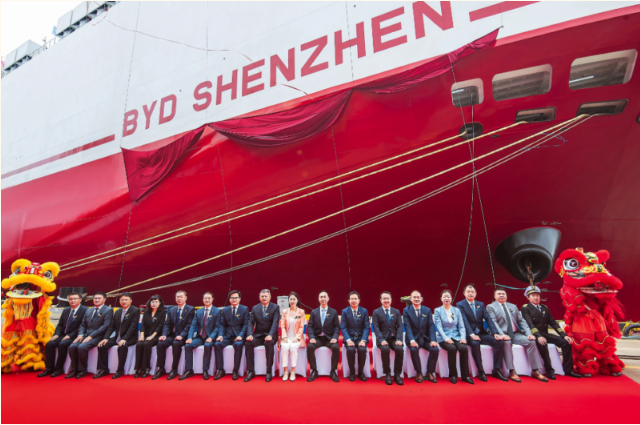

On April 27, BYD’s fourth roll-on/roll-off (RoRo) vessel, named Shenzhen, officially embarked on its inaugural ocean journey to Brazil, transporting over 7,000 new energy vehicles from Jiangsu, China. Brazil stands as BYD’s largest international market, and the company has experienced the swiftest growth in investments in Brazil among Chinese automakers over the last two years.

In 2024, BYD emerged as the “fastest growing brand” in Brazil, with popular models like the BYD Song Pro and Seagull.

Earlier this January, the BYD Shenzhen departed from the Yangzhou port, located approximately three hours northwest of Shanghai.

On April 22, BYD celebrated a delivery ceremony for the Shenzhen, which has a length of 219.9 meters and a width of 37.7 meters, featuring 12 decks. The BYD Shenzhen is capable of reaching maximum speeds of 18.5 knots (34.3 km/h) and can accommodate up to 9,200 vehicles at once, which corresponds to the area of 20 football fields, thus being the largest car carrier worldwide, as per official statements. The vessel is equipped with a dual-fuel propulsion system that utilizes Liquefied Natural Gas (LNG) alongside conventional fuel.

In the first quarter of 2025, BYD reported that its RoRo vessels had shipped over 25,000 new energy vehicles from China to destinations abroad. This figure is relatively small compared to BYD’s overseas sales figure of 206,000 units for the first quarter, representing a year-on-year growth of around 110%. In March alone, BYD’s international sales numbered 72,723 units. In the upcoming years, BYD plans to significantly expand its fleet of car carriers to meet increasing demand.

Since 2024, BYD has been operating four RoRo vessels, including Explorer No.1, Changzhou, Hefei, and Shenzhen. Looking forward, the company’s fifth RoRo vessel, “Changsha,” was launched in March and is anticipated to be delivered in May. Additionally, BYD launched the “Xi’an” RoRo ship in April, although the official delivery date is yet to be determined.

In the electric vehicle sector, a Chinese firm is outperforming Elon Musk’s Tesla, and it’s only just beginning.

BYD, the Shenzhen-based Chinese electric vehicle leader, surpassed Tesla in annual sales in the previous year. Recently, they introduced a groundbreaking battery charging technology that reportedly provides an additional 250 miles of range in just five minutes, which is more efficient than Tesla’s Superchargers that need 15 minutes for 200 miles of range. Furthermore, last month, BYD introduced “God’s Eye,” an advanced driver-assistance system that competes with Tesla’s Full Self-Driving feature, included at no additional cost in most of its vehicles.

These represent just three instances of BYD’s advancements over Tesla. The company, once dismissed by Musk, is currently leading Tesla in sales, innovation, and pricing strategies.

“They are not just sitting back, as demonstrated by the God’s Eye announcement and the rapid-charging technology reveal,” stated Tu Le, founder and managing director of Sino Auto Insights, in an interview with CNN. “They are motivated to push boundaries and establish trends for the global market.”

After successfully dominating its home market in China, the largest automobile market globally, BYD is beginning to broaden its international presence, with the notable exception of the United States, a market it faces significant barriers to entering due to 100% tariffs on its passenger automobiles.

Here’s a comprehensive overview of BYD’s ascent and its impact on the global landscape for clean energy vehicles.

What does BYD represent?

Founded in 1995 by Wang Chuanfu in Shenzhen, China’s megacity, BYD has become the country’s leading automaker. It exports electric taxis, buses, and various vehicles to regions across Europe, South America, Southeast Asia, and the Middle East.

In China, BYD represented 32% of the total sales of new energy vehicles last year, which encompasses hybrids, significantly outpacing Tesla’s 6.1% market share, according to the China Passenger Car Association. (BYD produces both battery-operated vehicles and hybrids, while Tesla solely manufactures fully electric vehicles reliant on batteries.)

BYD announced sales of $107 billion for 2024, marking a 29% increase from the prior year, driven by the delivery of 4.27 million vehicles, including hybrids. In contrast, Tesla reported revenues of $97.7 billion for 2024, delivering 1.79 million battery-operated vehicles, marking the company’s first annual delivery decline of 1.1%.

Although BYD’s battery-operated EV shipments were slightly lower than Tesla’s at 1.76 million vehicles, investors and analysts remain optimistic about BYD’s future, particularly as it expands into foreign markets. The majority of BYD’s deliveries were to domestic customers, with only 10% reaching international markets.

“We anticipate that sales will continue to thrive in 2025, allowing BYD to maintain its leadership with the introduction of next-generation models featuring advanced driver-assistance capabilities,” wrote Vincent Sun, Morningstar’s senior equity analyst, in a recent research note.

While many believe that BYD stands for “Build Your Dreams,” Wang clarified in a Tencent interview that the name originally held no such significance. It was simply a unique combination of three Chinese characters, “bi ya di,” he explained during the online interview, adding that the slogan “Build Your Dream” was created later for branding purposes.

What are its most sought-after models?

BYD’s leading passenger vehicles include the Qin and Song models, which attract a wide range of consumers attracted by the company’s reputation for being budget-friendly. The Qin is a compact sedan available in both plug-in hybrid and fully electric versions, while the Song features a series of compact SUV crossovers.

In contrast to Tesla, which has established itself as a luxury brand, BYD has achieved its success through affordability. Its base model starts at just over $10,000 in China, significantly less than Tesla’s most affordable Model 3, which retails for more than $32,000.

Although BYD has not yet introduced its passenger cars to the US market due to high tariffs, its electric buses are already operational in California.

Who is Wang Chuanfu?

Wang was born in 1966 into a modest rural family in Anhui province in eastern China. Unfortunately, tragedy struck when both of his parents passed away young, leaving him orphaned during middle school, according to The Paper, a state-owned Chinese publication. Wang depended on his older brother for support and education.

Wang spent several years at the state-owned Beijing Nonferrous Metals Research Institute, where he earned his master’s degree. The institute later set up a battery company in Shenzhen and transferred him there.

Recognizing an opportunity, Wang founded BYD with a team of about 20 individuals and 2.5 million yuan ($351,994) that he borrowed from his cousin, as reported by The Paper.

He quickly found initial success by taking advantage of China’s low labor costs, disrupting an industry that was previously dominated by Japanese firms.

In 2003, Wang acted on his instincts by entering the automotive sector, purchasing a struggling state-owned automaker for 269 million yuan ($38 million). The investors were concerned, causing the company’s shares to drop by over 30%. However, Wang remained steadfast.

Wang remembered that the automaker he acquired offered little technologically, so he purchased many used cars from around the globe and disassembled them to learn.

“Toyota, being the leading automaker worldwide, has craftsmanship, design, and products that are valuable to study — only by standing on its shoulders can we achieve greater heights,” he mentioned in the Tencent interview.

Eventually, he was proven right, receiving a $230 million investment in 2008 from Warren Buffet, whose backing brought him global recognition.

How can it sell its vehicles at such low prices?

BYD initially started as a battery manufacturer, which Wang stated laid a strong foundation for the company and paved the way for its success.

“The key challenge for electric vehicles is the battery,” he mentioned in the Tencent interview. “If you understand battery technology or can accurately foresee its future direction, you are essentially charting the strategic course for the entire EV sector.”

Similar to Apple founder Steve Jobs and Tesla CEO Elon Musk, Wang, who has a background in metallurgical chemistry, has always been focused on engineering details and continues to be. He stated in the Tencent interview that he dedicates around 60% to 70% of his time to technology and the remainder to management.

One of the innovations that emerged from BYD’s emphasis on technology is its blade battery, a lithium iron phosphate battery that the company introduced in 2020. The firm claims the distinctive shape maximizes space usage in the battery pack while minimizing the risk of fire when damaged.

In addition to batteries, BYD manufactures a high percentage of its components in-house, relying less on outside suppliers compared to other automakers. According to Le, this vertical integration enables the company to scale its production more efficiently and significantly reduce costs.

BYD is also recognized for its bold pricing approach during a persistent price war in China and is not hesitant to request discounts from its suppliers.

What’s preventing its cars from entering the US market?

Currently, BYD and other Chinese electric vehicles are largely excluded from the US market because of tariffs. However, as BYD progresses, Le indicated that trade barriers may create a “false sense of security” for some companies.

“They plan to continue heavily investing in research and development this year, leading to a sustained effort likely lasting through the end of this decade,” he stated.

Although BYD lacks a presence in the US, it is making headway in other regions.

Wang has committed to increasing overall shipments by almost 30% this year and aims to nearly double its international deliveries to more than 800,000 vehicles, as reported by state media.

However, some hurdles have surfaced.

“Beyond the geopolitical issues, I believe there are additional challenges in how they function in various countries,” remarked Lei Xing, an independent analyst who specializes in China’s automotive sector.

In Brazil, authorities announced in December that they discovered workers in “slavery-like conditions” at a BYD construction site. The company subsequently denied those allegations.

In Mexico, reports suggest that Beijing is postponing the approval of a local factory due to worries that BYD’s smart car technology might be transferred to the US, according to the Financial Times.

Nonetheless, some analysts view BYD as an unstoppable entity. With a strong emphasis on technology, Xing stated that BYD is set to bring forth new innovations, whether in terms of cost or advancement.

“They’re just getting started,” he added.