Data exchanges in contemporary 5G networks utilize pilot signals to assess conditions. They function like scouts sent to investigate the wireless landscape and relay their findings. However, they also consume resources, draining power and increasing costs. So, what if AI could assist networks, in addition to future transport systems, to operate without pilots?

This is precisely what an AI startup named DeepSig asserts to have accomplished recently. With the tools provided by Nvidia, a key player in the AI boom, DeepSig has reportedly eliminated the conventional signal processing algorithms created by highly skilled individuals and substituted them with a neural receiver. “Optimization is a very good problem for AI,” remarked Soma Velayutham, Nvidia’s general manager for AI and telecom, expressing admiration for DeepSig’s achievement. He believes that DeepSig’s pilotless method could enhance spectral efficiency by anywhere from 16% to 50%.

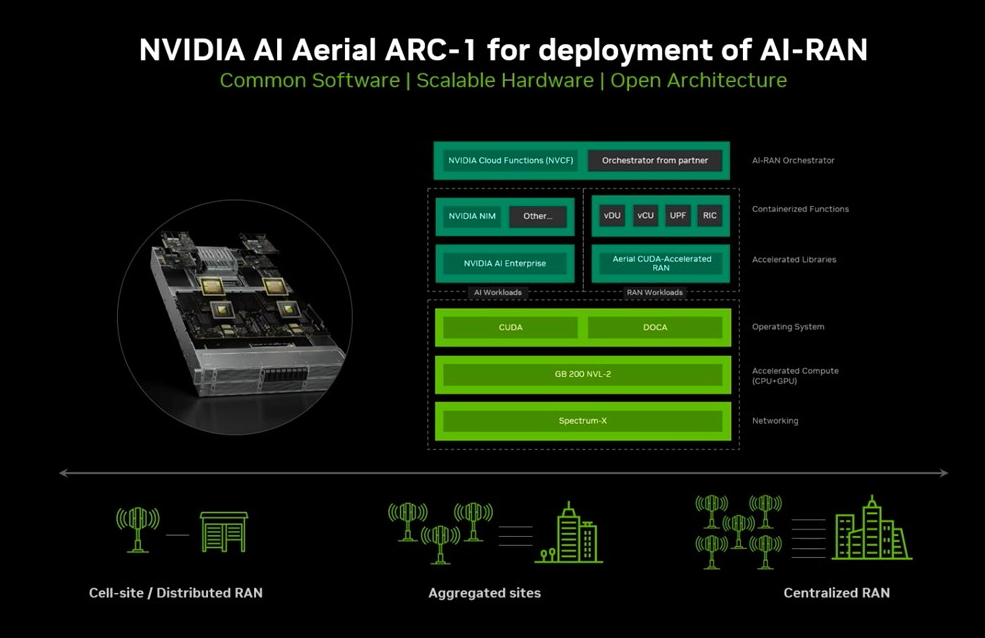

DeepSig serves as just one illustration of how Nvidia and AI could fundamentally transform the construction and management of future 5G and 6G networks. The major American chip manufacturer, currently valued at around $3.2 trillion, has been advocating its graphics processing units (GPUs) as the essential foundation for what it describes as an AI RAN for the past year. This initiative includes running mainstream AI applications on the same GPU hardware used to host RAN software. However, the concept of applying AI to RAN, where neural networks could potentially replace the stochastic models of 5G, might prove to be significantly disruptive to the industry and its participants.

At present, some of the most intricate RAN algorithms are part of what is known conceptually as the physical layer, or Layer 1, of the network. Companies such as Ericsson and Nokia treat these like precious resources, guarding them fiercely. Nevertheless, Nvidia has introduced its own Layer 1 software called Aerial, developed on its compute unified device architecture (CUDA) platform. Notably, it has made the source code of Aerial available, encouraging others to innovate.

Eliminating the pilot

Nvidia, of course, is not genuinely interested in profiting from RAN software. Its main objective is to increase GPU sales. If the company can convince the industry that 5G and 6G would benefit significantly from a GPU platform, rather than relying on custom silicon or general-purpose central processing units (CPUs), it does not particularly care who develops the RAN or what neural networks might mean for traditional signal-processing algorithm developers.

“Traditionally, your physical layer, or Layer 1, has been developed using conventional signal processing blocks,” stated Ronnie Vasishta, Nvidia’s senior vice president of telecom. “What we’ve managed to do by incorporating a GPU into the system is enable that physical layer to also be modeled by a neural network.”

Nvidia’s release of Aerial allows developers to take a block of Layer 1 source code, substitute it with a neural receiver, and experiment. With a suitable modular approach, a developer could concentrate on a specific aspect such as channel estimation, according to Velayutham. However, high-quality data is also essential to support the training of the neural receiver and subsequent simulation, he informed Light Reading. To aid in this, Nvidia has also launched an open-source simulator called Sionna, which has been downloaded approximately 120,000 times over the past year.

DeepSig’s pilotless advancement is not the only instance of AI for RAN being showcased by Nvidia at Mobile World Congress in Barcelona this week. A collaboration between Fujitsu, Nvidia, and SoftBank has also succeeded in enhancing spectral efficiency in adjacent cells by incorporating AI into the channel interpolation process. Separately, Samsung and Keysight have been testing neural receivers for channel estimation. “It’s essentially about determining how noisy my environment is and using AI to characterize that,” noted Velayutham.

Meanwhile, Kyocera and Singapore’s SynaXG have been demonstrating what they claim is the world’s first millimeter-wave AI RAN. This utilizes the Aerial platform and one of Nvidia’s Grace Hopper superchips, which combines an Arm-based CPU (Grace) for higher-layer RAN functions with a GPU (Hopper) for Layer 1. The GPU, Velayutham insists, provides far superior scalability compared to the fixed-function accelerators commonly found in open and virtual RAN products for massive MIMO, an advanced 5G technology.

“It doesn’t have to be our Layer 1, or it could consist of components of our Layer 1, and while we’ve implemented a Layer 1 in Aerial, it encompasses more than just Layer 1,” explained Vasishta. “We’re decidedly open to whether it be SynaXG, or Fujitsu and SoftBank, or how Ericsson and Nokia wish to implement their own functionalities.”

Different creature

Both Ericsson and Nokia have become members of the rapidly expanding AI-RAN Alliance led by Nvidia. However, this entire concept undeniably places them in a challenging position. For an extended period, they have had to juggle investments in specialized 5G technology versus the growing interest in virtual or cloud RAN, where their proprietary silicon is replaced by general-purpose processors. Nevertheless, telecom companies appear skeptical that the advantages of virtual RAN justify the expenses, which likely reassures the Nordic vendors as progress has been sluggish. While Nvidia presents AI RAN as compatible with ideas of openness and virtualization, it could, in fact, represent a completely different entity.

Critics have been quick to dismiss Nvidia’s proposal, highlighting the high costs and energy demands associated with its GPUs. However, this overlooks the potential for neural networks to mitigate those costs by enhancing the spectral efficiency of 5G and 6G. It also ignores the potential revenue opportunities for telecom companies through AI in RAN, as well as the multifunctional use of GPUs to not only support the RAN but also deliver AI inference-as-a-service at the telco edge. SoftBank, which is testing an AI RAN in Japan, has controversially suggested that telecom companies could earn $5 for every $1 invested over a five-year span.

The Nordic vendors might watch activities similar to DeepSig with some concern. If GPUs gain broader adoption and Nvidia lowers barriers for new players that open RAN has struggled to overcome, neural networks may diminish the value of traditionally created algorithms. Conversely, AI RAN could also offer a growth opportunity for firms in an industry that has seen annual revenues decline by about $10 billion in just two years. “It introduces an innovative perspective that hasn’t existed before with AI, and I believe that’s very positive for both established vendors and new entrants,” Vasishta said.

Indosat, Nokia and Nvidia to develop and deploy AI-RAN

Indonesian telecommunications company Indosat Ooredoo Hutchison announced on Wednesday that it has entered into a Memorandum of Understanding (MoU) with Nokia and Nvidia during Mobile World Congress 2025 to implement AI-RAN infrastructure in Indosat’s network.

This agreement will allow Indosat to incorporate Nokia’s 5G Cloud RAN solution alongside Nvidia’s AI Aerial platform to establish a combined accelerated computing infrastructure capable of hosting both AI and RAN tasks.

According to the MoU, Indosat, Nokia, and Nvidia will collaborate on the development, testing, and deployment of the AI-RAN solution, initially focusing on integrating AI inferencing workloads on Nvidia AI Aerial, followed by the inclusion of RAN workloads on the same platform.

In addition to improving network performance, spectral efficiency, and energy usage, AI-RAN will also set the foundation for a future software upgrade to 6G, as stated by Indosat.

Tommi Uitto, Nokia’s President of Mobile Networks, remarked that AI-RAN will enable Indosat to reduce infrastructure costs across various applications and optimize its return on investment while creating new revenue opportunities through AI-enhanced services.

“When AI is integrated with RAN, it fosters an engine for upcoming innovations,” Uitto said in a joint announcement. “With our 5G Cloud RAN platform, Indosat can transform its network into a versatile computing grid that utilizes the benefits of AI-accelerated computing.”

The three partners will initiate the project by setting up a 5G AI-RAN laboratory in Surabaya at the start of 2025 for collaborative development, testing, and validation. Indosat aims to launch a preliminary commercial trial of AI inferencing workloads operating on NVIDIA AI-RAN infrastructure in the latter half of this year, with plans for further deployment of the solution expected in 2026.

Indosat’s president director and CEO Vikram Sinha stated that this initiative positions the company as the first operator in Southeast Asia and the third globally to establish a commercial AI-RAN network.

“By integrating AI into our radio access network, we’re not only improving connectivity – we’re creating a nationwide AI-powered ecosystem that will drive innovation in various industries,” he expressed in a statement.

As part of this initiative, Indosat, Nokia, and NVIDIA will also collaborate with Indonesian universities and research institutions to advance AI-RAN development by supporting academic initiatives aimed at promoting AI innovation in telecom use cases and accelerating advancements in AI-driven network optimization, spectral efficiency, and energy consumption.

This agreement represents the latest collaboration on AI with Indosat and Nvidia, which signed an MoU at last year’s MWC to work on positioning Indonesia as a prominent player in the AI sector. The MoU included plans for Indosat’s ICT division Lintasarta to introduce a GPU-as-a-Service offering called GPU Merdaka, which was revealed in August 2024.

This is also one of several AI-RAN announcements made at MWC25, with notable mention of Ericsson and Japanese telecom company SoftBank—who established the AI-RAN Alliance at last year’s MWC—reporting their advancements in AI-RAN development.

Among other developments, Ericsson and SoftBank announced that they have showcased a prototype of Ericsson Cloud RAN software utilizing the Grace CPU of Nvidia’s Grace Hopper Superchip, and have outlined an architecture for orchestrating both RAN and AI applications on a unified infrastructure.

On Monday, the two companies signed an MoU to broaden their research on the feasibility of transferring selected RAN functions to the GPU employing the Grace Hopper platform. They will also develop a prototype for coordinating the orchestration of AI and RAN workloads by aligning SoftBank’s orchestrator from their AITRAS solution with Ericsson’s open network management and automation platform, as well as examining AI applications for robotic functions using Ericsson’s compute offloading framework.