There’s significant enthusiasm currently surrounding the latest premium smartphones from brands like Apple and Huawei, but what about the low-end market? The demand for affordable devices is increasing as Asian markets drive this growth, as noted by Counterpoint Research.

A strong global recovery in smartphone sales is taking place, with shipments of 5G devices rising by 20% in the first half of 2024, according to the industry analytics firm.

Notably, the growth has recently shifted toward the budget phone segment priced under $150, where Asian manufacturers such as Xiaomi, Vivo, and Samsung (which already holds a substantial 21% of the 5G handset market) are actively gaining more ground.

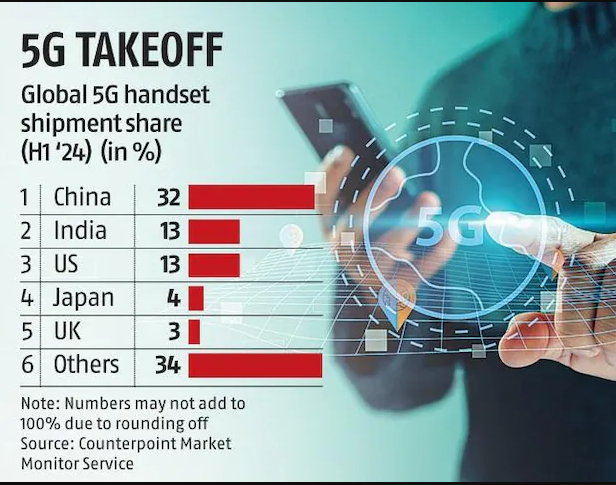

Additionally, the interest in these devices is robust in the region. Counterpoint reveals that 58% of all 5G device shipments went to Asia Pacific markets in the first half of the year, with India, responsible for 13% of all 5G device shipments, surpassing the US to become the second-largest market for 5G devices, while China maintains a leading 32% market share.

During the second quarter of this year, shipments of budget smartphones (encompassing all mobile technologies, not limited to 5G) exceeded 100 million, representing 37% of total global smartphone shipments. However, there’s a notable trend toward 5G devices even within the budget category, as 5G smartphones comprised 24% of budget device shipments in that quarter.

To accommodate this demand, new players are creating budget devices for important markets, exemplified by the collaboration between major Indian operator Reliance Jio and Google to develop an affordable 5G smartphone, first revealed in September 2022.

Indeed, the partnership between Jio and Google may signal future developments with smartphone manufacturers and service providers. Jio plans to transition its core retail operations to Google Cloud infrastructure, allowing Google to develop a comprehensive cloud solution for managing Jio’s 5G network and services. After this integration, Jio expects that many of its customers will leverage Google’s AI/ML, ecommerce, and demand-forecasting applications.

This type of collaboration among smartphone original equipment manufacturers (OEMs), cloud service providers, and mobile operators could enhance and reinforce the presence of budget 5G devices and services in Asia and potentially worldwide, signifying a pivotal moment for the global 5G sector.

Historically, major telecommunications companies and the GSMA, the industry association representing them, relied on 5G to deliver advanced corporate services like network slicing, aiming to create new revenue “streams” (“revenue streams” sounds more expansive and indefinite than simply “revenues”). However, waning demand and the effects of the post-pandemic situation have dampened that ambition for now.

One method to counteract the weak interest in high-value, high-margin business is to pursue scale through budget 5G, an area in which Indian telcos particularly excel. The goal is to provide improved end-user services at equal or lower cost while controlling marketing expenses and sales costs, as well as reducing per-subscriber expenses through greater automation and more cost-effective infrastructure and deployment strategies.

Fundamentally, implementing 5G services on a modern infrastructure allows for broader coverage to attract a large number of marginally profitable customers, rather than painstakingly pursuing a few high-value corporate clients.

The ‘budget 5G’ strategy is thought to be especially appealing in emerging markets, according to mobile market analysts, where numerous potential subscribers are ready to embrace 5G if affordable device and service options are available.

Meanwhile, the adverse effects of the US’s efforts to undermine Huawei seem to have ultimately benefitted the Chinese company. Huawei’s workaround solutions to the advanced chips it has been prohibited from using may be providing it with a viable technical foundation to enhance its 5G capabilities, although its new tri-fold phone, priced at over $2,800, is certainly not a budget offering—see Huawei extends its tri-fold challenge to the iPhone 16.

Regarding market share, Greater China’s smartphone sales (including those in Hong Kong and Taiwan) already appear to be performing well, as indicated by Counterpoint, with a year-on-year increase of 6%, primarily due to overall demand recovery. At the same time, Apple’s share of the Chinese market experienced a slight decline in the single digits.

According to a recent report by Counterpoint Research, India has become the second-largest market for 5G smartphones globally, coming in just behind China. 5G smartphones are increasingly visible across different price categories in India.

Prachir Singh, a senior analyst at Counterpoint Research, noted that significant contributions from companies like Samsung, Vivo, and Xiaomi, particularly in the budget category, have played a critical role in this expansion.

“During the first half of the year, India emerged as the second-largest 5G handset market, surpassing the US. The notable shipments from Xiaomi, Vivo, Samsung, and other brands in the budget sector were the primary factors behind this trend,” Singh remarked.

China retains its top position with a 32 percent share of the global 5G smartphone market, while India captures 13 percent. The US has slipped to third place, holding a 10 percent market share.

On a global scale, Apple leads in 5G handset shipments with over 25 percent of the market, primarily driven by the iPhone 15 and iPhone 14 series. Samsung follows closely with an over 21 percent market share, largely due to its Galaxy A and S24 series. In the first half of 2024, both Apple and Samsung secured five spots in the top ten list of 5G models, with Apple dominating the top four positions.

India has significantly contributed to Xiaomi’s growth, helping it reach the third position worldwide. Counterpoint Research indicated that Xiaomi saw a triple-digit growth rate in India and double-digit growth in the Middle East, Africa, Europe, and China.

Likewise, India has been a vital growth driver for Vivo, alongside China and other emerging Asian markets.

Tarun Pathak, research director at Counterpoint Research, stated that in the first half of 2024, over 54 percent of the total handset market consisted of 5G-enabled devices, marking the first time it surpassed the 50 percent milestone.

“As the accessibility of 5G handsets increases with a broader reach in lower price segments and the extended availability of 5G networks, this trend will likely continue to rise. Additionally, the ongoing global trend of premiumisation will further enhance this growth. Based on our market forecast, the share of 5G is expected to exceed 57 percent in 2024 and 65 percent in 2025,” he added.

Although 2024 didn’t meet all my expectations for 5G on several fronts, I believe the year laid the groundwork for significant advancements in 2025. AI made considerable strides in various areas, alongside low earth orbit satellite connectivity, network slicing, and new devices. Despite being a tough year for numerous 5G companies, including some infrastructure providers, 2024 appeared to be a foundational period for future progress, particularly with 5G-Advanced and even 6G. Nevertheless, it’s worth noting that discussions around 6G feel somewhat premature as we are still not fully experiencing the 5G world that was promised, largely due to the global scarcity of 5G Standalone networks.

Once the 3GPP governing organization approved Release 17 of its wireless telephony specifications in 2022, it became evident that satellite connectivity would play a substantial role in 5G. While satellite technology is still in its early stages, the momentum can’t be ignored, with partnerships formed between companies like SpaceX, AST SpaceMobile, and T-Mobile, among other operators. T-Mobile is expected to roll out its direct-to-cell service in beta in early 2025, competing with offerings from companies such as Apple, which has teamed up with Globalstar. Additional carriers, including AT&T, Vodafone, and Verizon, have entered into agreements with AST SpaceMobile, and Vodafone has recently showcased satellite video calling using AST SpaceMobile’s commercial BlueWalker satellites.

Regarding Globalstar, the company announced intentions to develop an LEO satellite network mainly for Apple’s use, although specifics were limited apart from a $1.5 billion investment from Apple. This comes in addition to the $450 million Apple previously invested with Globalstar in 2022 to bring Emergency SOS functionality to the iPhone 14 and later models. With Apple investing nearly $2 billion in enabling direct-to-cell satellite technology, there seems to be a consensus in the industry that this is the future trajectory for 5G and likely 6G.

While chipsets such as Qualcomm’s X80 modem with integrated NB-NTN capability are featured in most flagship Android devices in 2024, Apple has opted for a modified X71 modem from Qualcomm that does not support NTN. MediaTek has been producing an IoT-NTN component known as the MT6825 — a discrete IoT chip for satellite use — and is expected to incorporate that capability into its modems in the near future.

In terms of NTN, the European Space Agency collaborated with Telesat to conduct real-world 5G NTN trials using a commercial satellite from Telesat (the LEO 3). This is significant, as we are witnessing a growing acceptance of 5G NTN as the standard with Release 17, and further enhancements are anticipated in 3GPP Rel. 18 and Rel. 19. While 2025 might not mark the year when satellite technology becomes mainstream, it promises to be a significant year for the satellite sector, with numerous headlines expected. Conversations with industry veterans suggest that 2026 and 2027 will likely be when satellite connectivity truly reaches mainstream status.

AI has been around in various forms for quite a while, but the excitement really peaked at the end of 2022, surged throughout 2023, and has maintained a high level through 2024. Even so, AI has proven crucial to both 5G and 6G, especially when examining developments in radio access network technology and modems. Companies like Ericsson, Nokia, and Nvidia have been at the forefront of the AI-RAN field, while Qualcomm has long been a leader in the modem arena. AI might ultimately be the technology that facilitates compute capabilities at the edge, which are essential for enabling XR technologies and other applications that require low-latency computing.

Among major carriers, T-Mobile’s collaborative announcements with OpenAI, Nvidia, and Ericsson have underscored how critical AI will be for network operations and management. T-Mobile appears optimistic that its adoption of AI will enhance network efficiencies, improve customer service experiences, and broaden coverage, as I highlighted during its Capital Markets Day.

Verizon has also made strides with its own 5G private network solution developed in partnership with Nvidia. Verizon has a longstanding reputation for robust MEC capabilities, so the integration of Nvidia GPUs seems a logical next step, particularly since I believe AI will drive an increased demand for 5G. Additionally, Verizon has introduced its new AI strategy called Verizon AI Connect, which merges the company’s strengths in MEC and Fiber with its latest private 5G solutions that utilize Nvidia GPU computing. I strongly believe that companies like Verizon and T-Mobile may leave open the possibility for edge computing applications that extend beyond just AI and 5G, due to the proximity of GPUs to the network edge. This could lead to innovations such as ultra-thin AR glasses and an array of 3-D applications at the edge.

5G Phones And 5G AI PCs

In general, 2024 proved to be a positive year for smartphones as the industry bounced back from the decline experienced in 2023, largely due to economic issues in China. Despite this, several smartphone companies shifted their attention to different sectors. A notable example is Xiaomi, which garnered significant praise and surprise with the launch of its SU7 electric vehicle. Similarly, Huawei introduced the world’s first trifold smartphone, leading the industry in innovative foldable designs, while Motorola discreetly attracted iPhone customers over to Android with its Razr phone line (as I detailed in my recent review of the Razr+).

We also witnessed a plethora of on-device AI demonstrations and features from chip manufacturers, particularly Qualcomm and MediaTek, and we can expect even more AI, especially in the form of agents, to emerge in 2025. However, much of the current AI still operates through the cloud, and as those expenses continue to grow, I anticipate that hybrid AI will become the prevailing method of AI computing, particularly with efficient models like the new DeepSeek R1 facilitating greater on-device processing. This hybrid AI strategy will, as noted earlier, necessitate more AI processing power at the edge, but it will also require 5G connectivity to provide low-latency experiences and manage the significant amounts of data needed to enhance AI functionality effectively.

I also believe that Google’s method of on-device AI will gain more prominence, and that its success with the Pixel 9 series will bolster momentum for the Pixel 10, which may address the persistent issues users encounter with Pixel phones regarding connectivity and battery lifespan. Google has closely collaborated with various OEMs — including Samsung on the Galaxy S25 — to implement its Gemini 2.0 model in ways that optimize both on-device and cloud computing for an improved user experience in features such as Gemini Live.

I think that these elements could encourage a greater number of individuals to adopt 5G-connected AI PCs, as many of the functionalities of AI PCs rely on an internet connection — and 5G is widely available in regions like the U.S. and Western Europe, generally offering high-speed performance. While it is evident that smartphones like the new Samsung Galaxy S25 will lead the charge in AI capabilities, I believe that AI PCs equipped with 5G connectivity could significantly enhance productivity by combining their powerful NPUs with AI-powered tools. We may also witness satellite technology enabling AI applications that were previously unfeasible, such as real-time predictive logistics that are more accurate and intelligent.

Regardless of which specific predictions materialize, it is reasonable to anticipate that the collaborative advancement of 5G networks (particularly Standalone 5G), more advanced mobile devices, novel AI-driven functionalities and deployment strategies, LEO satellites, and more will position this sector as a hub of technological innovation in 2025.